Recap for January 30

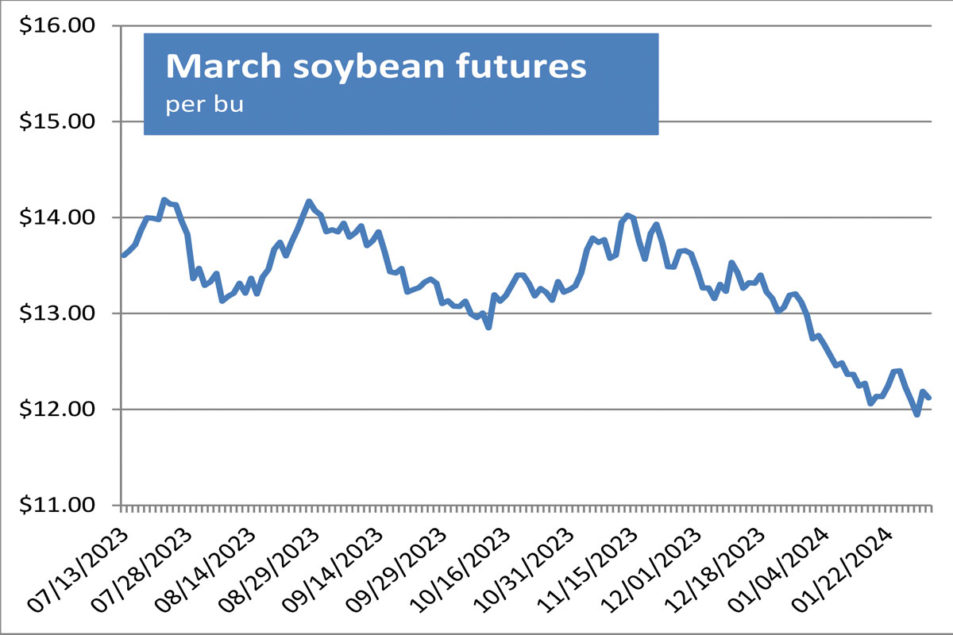

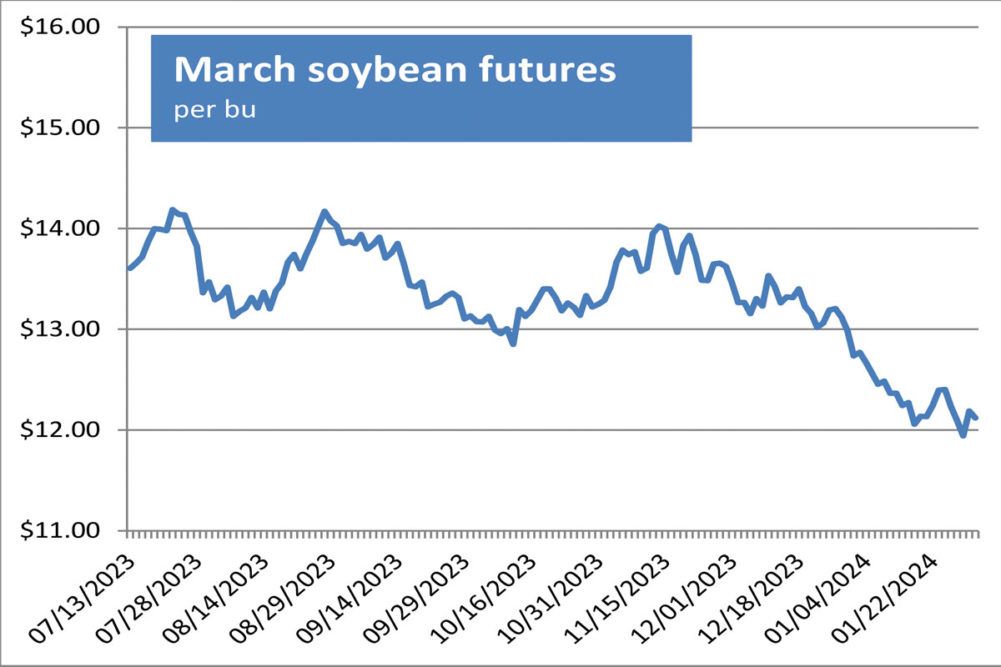

- Bargain buying off multi-year lows sent corn and soybean futures higher Tuesday despite the absence of supportive supply-demand news. Corn futures were down 5% for the month while soybean futures were down 6% in the same period, a reflection of ample US supplies after 2023’s bumper crops and rising confidence in South American crops. Wheat complex futures followed the firm trend, bouncing off one-week lows. The March corn future added 7½¢ to close at $4.47¾ per bu. Chicago March wheat advanced 12¢, closing at $6.05½ per bu. Kansas City March wheat jumped 12½¢ to close at $6.30¾ per bu. Minneapolis March wheat climbed 6½¢ to close at $6.99¾ per bu. March soybeans soared 24½¢ to close at $12.18¾ per bu. March soybean meal added $8.70 to close at $363 per ton. March soybean oil added 0.45¢ to close at 46¢ a lb.

- A fresh slate of company earnings reports left US equity markets mixed Tuesday. General Motors shares soared 7.8% after an unexpectedly optimistic profit outlook. United Parcel Service shares dropped 8.2% after its report said revenue declined in the fourth quarter and it would slash 12,000 jobs this year. The Dow Jones Industrial Average added 133.86 points, or 0.35%, to close at 38,467.31. The Standard & Poor’s 500 eased 2.96 points, or 0.06%, to close at 4,924.97. The Nasdaq Composite dropped 118.15 points, or 0.76%, to close at 15,509.9.

- US crude oil prices were higher Tuesday. The March West Texas Intermediate light, sweet crude future was up $1.04 to close at $77.82 per barrel.

- The US dollar index weakened Tuesday.

- US gold futures advanced Tuesday as the dollar declined. The February contract added $6.10 to close at $2,031.50 per oz.

Recap for January 29

- Growing potential for large South American harvests and worries about demand amid top global soy buyer China’s struggles with a real estate crisis sent US soybean futures below $12 a bu to two-year lows on Monday. Crude oil weakness and US dollar strength sent corn futures to a one-week low. The dollar plus spillover pressure from soybeans and corn weighed on wheat complex futures as the European Commission raised its forecasts for European Union stocks of common wheat. The March corn future dropped 6¢ to close at $4.40¼ per bu. Chicago March wheat dropped 6¾¢, closing at $5.93½ per bu. Kansas City March wheat fell 6½¢ to close at $6.18¼ per bu. Minneapolis March wheat fell 10¼¢ to close at $6.93¼ per bu. March soybeans dropped 15¢ to close at $11.94¼ per bu. March soybean meal added $5.30 to close at $354.30 per ton. March soybean oil fell 1.38¢ to close at 45.55¢ a lb.

- Investors positioning themselves ahead of a busy week of earnings reports sent US equity indexes higher and the DJIA and S&P posted fresh record-high closes Monday. The Dow Jones Industrial Average added 224.02 points, or 0.59%, to close at 38,333.45. The Standard & Poor’s 500 added 36.96 points, or 0.76%, to close at 4,927.93. The Nasdaq Composite added 172.68 points, or 1.12%, to close at 15,628.04.

- US crude oil prices were lower Monday. The March West Texas Intermediate light, sweet crude future was down $1.23 to close at $76.78 per barrel.

- The US dollar index opened the week on the upside with a stronger close.

- US gold futures advanced Monday. The February contract added $8.10 to close at $2,025.40 per oz.

Recap for January 26

- Wheat futures dropped lower in technical selling profit taking and signals the global export business may be cooling off. Soybean futures dipped to a one-week low Friday after the Buenos Aires Grains Exchange on Thursday raised its estimate of Argentina’s soybean crop to 52.5 million tonnes, up about 1% from its previous forecast. Corn futures dropped lower Friday after the BAGE a day earlier increased its estimate of Argentina’s corn crop to 56.5 million tons, up nearly 3% from its previous forecast. The March corn future dropped 5½¢ to close at $4.46¼ per bu. Chicago March wheat dropped 12¢, closing at $6.00¼ per bu. Kansas City March wheat fell 12¼¢ to close at $6.24¾ per bu. Minneapolis March wheat fell 5½¢ to close at $7.03½ per bu. March soybeans shed 13¾¢ to close at $12.09¼ per bu. March soybean meal fell $9.20 to close at $349 per ton. March soybean oil added 0.40¢ to close at 46.93¢ a lb.

- A week of upside momentum for US equity markets that included several fresh record highs ended with mixed closes Friday but weekly gains. Intel’s tepid projections pushed shares of the company down 12%, their largest decrease since July 2020, and other tech company shares, such as Advanced Micro Devices, Nvidia and Micron Technology, all finished lower. The Dow Jones Industrial Average added 60.30 points, or 0.16%, to close at 38,109.43. The Standard & Poor’s 500 dropped 3.19 points, or 0.07%, to close at 4,890.97. The Nasdaq Composite shed 55.13 points, or 0.36%, to close at 15,455.36.

- US crude oil prices were higher again on Friday. The March West Texas Intermediate light, sweet crude future added 65¢ to close at $78.01 per barrel.

- The US dollar index weakened into the weekend.

- US gold futures eased Friday. The February contract lost 50¢ to close at $2,017.30 per oz.

Recap for January 25

- Wheat futures continued to climb Thursday on optimism that North America and Europe could pick up some global demand amid geopolitical tension in the Middle East and terrorism in the Red Sea. Soybean futures declined Thursday after the USDA said export sales of US soybeans in the week ended Jan. 18 were 560,900 tonnes, below a range of trade expectations for 700,000 to 1,200,000 tons. Corn futures were lower under pressure from ample US inventories, uncertain demand and spillover weakness. The March corn future fell ½¢ to close at $4.51¾ per bu. Chicago March wheat added 1½¢, closing at $6.12¼ per bu. Kansas City March wheat jumped 11¼¢ to close at $6.37 per bu. Minneapolis March wheat added 4½¢ to close at $7.09 per bu. March soybeans deleted 17¼¢ to close at $12.23 per bu. March soybean meal fell $5.10 to close at $358.20 per ton. March soybean oil dropped 0.79¢ to close at 46.53¢ a lb.

- US equity markets closed higher Thursday after a Commerce Department report indicated the economy grew at a 3.3% seasonally and inflation-adjusted annualized pace in the fourth quarter, fueled by household and government spending. The quarterly reading was a slowdown from the summer’s 4.9% pace but still a healthy rate. The Department said the US economy grew 3.1% over the past year. The Dow Jones Industrial Average added 242.74 points, or 0.64%, to close at 38,049.13. The Standard & Poor’s 500 added 25.61 points, or 0.53%, to close at 4,894.16. The Nasdaq Composite added 28.58 points, or 0.18%, to close at 15,510.50.

- US crude oil prices were higher Thursday. The March West Texas Intermediate light, sweet crude future added $2.27 to close at $77.36 per barrel.

- The US dollar index resumed its climb Thursday.

- US gold futures closed higher Thursday. The February contract added $1.80 to close at $2,017.80 per oz.

Recap for January 24

- US equity indexes closed higher Wednesday, driven by strong performances from the so-called Magnificent Seven: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. Investors were encouraged to return to large-cap tech shares by ideas the economy is likely too strong for the Federal Reserve to cut interest rates as swiftly as some hoped. The Dow Jones Industrial Average dropped 99.06 points, or 0.26%, to close at 37,806.39. The Standard & Poor’s 500 edged up 3.95 points, or 0.08%, to close at 4,868.55. The Nasdaq Composite added 55.97 points, or 0.36%, to close at 15,481.92.

- A pause in the US dollar’s January jump boosted wheat futures Wednesday, the prompt Chicago contract up 2.4% in apparent chart-based trading. The dollar’s direction also helped KC and Minneapolis futures higher, offsetting SovEcon’s increase in its projection of Russia’s 2024 wheat production to 92.2 million tons from 91.3 million as its December estimate. Corn futures benefited from the dollar’s pause plus stressful heat in Argentina and an expected lower production from Brazil’s second crop. Soybean futures were narrowly mixed Wednesday in choppy trade influenced by South American crop prospects and profit taking. The March corn future added 5¾¢ to close at $4.52¼ per bu. Chicago March wheat jumped 14¼, closing at $6.10¾ per bu. Kansas City March wheat advanced 8¼¢ to close at $6.25¾ per bu. Minneapolis March wheat added 5½¢ to close at $7.04½ per bu. March soybeans edged up ¾¢ to close at $12.40¼ per bu with later months mixed narrowly. March soybean meal added $2.20 to close at $363.30 per ton. March soybean oil dropped 0.89¢ to close at 47.32¢ a lb.

- US crude oil prices were higher Wednesday. The March West Texas Intermediate light, sweet crude future added 72¢ to close at $75.09 per barrel.

- The US dollar index weakened Wednesday, closing lower for the second time in seven trading days.

- US gold futures closed lower Wednesday. The March contract dropped $9.80 to close at $2,016 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |