Recap for February 7

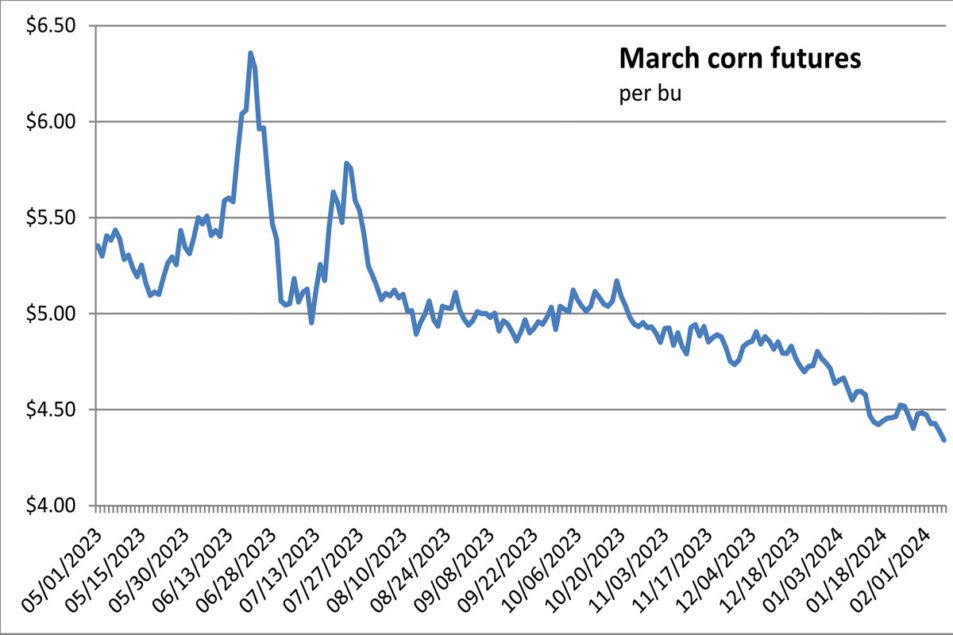

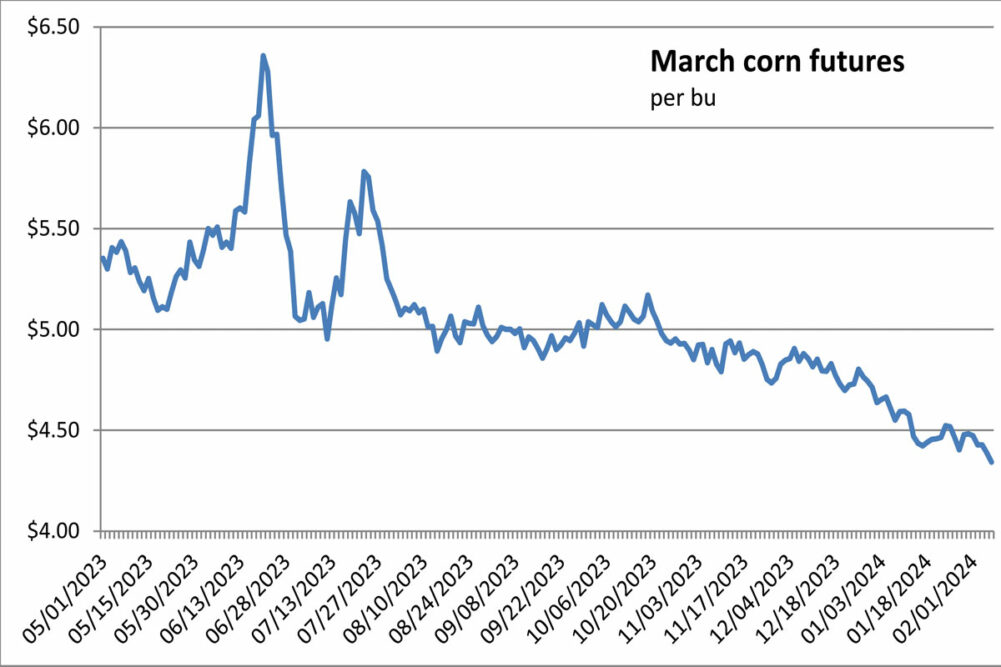

- Corn prices struck a three-year low Wednesday after weather reports indicated competitor Argentina will flip from hot, dry weather to widespread rain. Wheat complex futures were mixed with Chicago soft wheat advancing. Supply pressure stemming from Russia’s surplus and favorable new crop prospects weighed on wheat as traders squared positions ahead of key US and Canadian supply-demand reports coming Thursday. Soybean prices reached the lowest levels since Dec. 15, 2020, as Brazilian growing regions also had rainy forecasts. The March corn future dropped 4½¢ to close at $4.34¼ per bu. Chicago March wheat added 7¢, closing at $6.02 per bu. Kansas City March wheat eased ¼¢ to close at $6.18¼ per bu; later months were narrowly mixed for a second day. Minneapolis March wheat added 3¢ to close at $6.96¼ per bu; later months were narrowly mixed. March soybeans fell 10½¢ to close at $11.89 per bu. March soybean meal shed $7.60 to close at $351.20 per ton. March soybean oil rose 0.82¢ to close at 46.76¢ a lb.

- US equity markets were higher again Wednesday despite recent news about the pace of interest rate cuts. The DJIA and S&P 500 posted record-high closes. The Dow Jones Industrial Average added 156 points, or 0.4%, to close at 38,677.36. The Standard & Poor’s 500 was up 40.83 points, or 0.82%, to close at 4,995.06, its eighth record-high close of 2024. The Nasdaq Composite added 147.65 points, or 0.95%, to close at 15,756.64.

- US crude oil prices were higher again Wednesday. The March West Texas Intermediate light, sweet crude future was up 55¢ to close at $73.86 per barrel.

- The US dollar index declined for a second day Wednesday.

- US gold futures advanced Wednesday as the US dollar weakened. The February contract added 70¢ to close at $2,035.20 per oz.

Recap for February 6

- Wheat complex futures posted mixed closes Tuesday. Chicago soft wheat contracts were up for the first time in three sessions in short covering moves while KC and Minneapolis wheat futures were mixed ahead of key US and Canadan crop reports coming Thursday. Soybean futures popped higher a second day in short covering and technical buying off of lows a day earlier. Corn futures eased in the nearby contract on rainy forecasts for hot, dry Argentina. The March corn future dropped 4¢ to close at $4.38¾ per bu with later months mixed in a narrow range. Chicago March wheat added 4¾¢, closing at $5.95 per bu. Kansas City March wheat added 4½¢ to close at $6.18½ per bu; later months were narrowly mixed. Minneapolis March wheat added 2¼¢ to close at $6.93¼ per bu; later months were mixed. March soybeans rose 3¼¢ to close at $11.99½ per bu. March soybean meal deleted $2.30 to close at $358.80 per ton. March soybean oil rose 0.61¢ to close at 45.94¢ a lb.

- US stocks initially retreated modestly Tuesday with major indexes flipping between small gains and losses before edging higher by closing bells as investors recalibrated their ideas about the Federal Reserve’s interest rate path. The Dow Jones Industrial Average added 141.24 points, or 0.37%, to close at 38,521.36. The Standard & Poor’s 500 was up 11.42 points, or 0.23%, to close at 4,954.23. The Nasdaq Composite added 11.32 points, or 0.07%, to close at 15,609. All three major indexes retained gains for 2024, which was a positive sign for some Wall Street traders.

- US crude oil prices were higher again Tuesday. The March West Texas Intermediate light, sweet crude future was up 53¢ to close at $73.31 per barrel.

- The US dollar index declined Tuesday after a two-session rally.

- US gold futures advanced Tuesday as the US dollar weakened. The February contract added $8.80 to close at $2,034.50 per oz.

Recap for February 5

- The US dollar index climbed again on Monday as investors continued to digest Friday’s Department of Labor reports showing US employers added more than double the expected jobs in January and that the unemployment rate held steady at 3.7% last month, bucking expectations of an increase.

- US wheat futures were under pressure to open the week from a stronger US dollar and last week’s declines in Russian wheat prices. Soybean futures overcame the dollar’s pressure and climbed as traders began to adjust positions ahead of fresh supply-demand data coming Thursday from the US Department of Agriculture. Corn futures traded choppily and closed mixed ahead of Thursday’s USDA report. The March corn future was steady at $4.42¾ per bu with later months mixed in a narrow range. Chicago March wheat dropped 9½¢, closing at $5.90¼ per bu. Kansas City March wheat shed 11¢ to close at $6.14 per bu. Minneapolis March wheat dropped 8¾¢ to close at $6.91 per bu. March soybeans ascended 7¾¢ to close at $11.96¼ per bu. March soybean meal added $4.30 to close at $361.10 per ton. March soybean oil rose 0.6¢ to close at 45.33¢ a lb.

- US equity markets fell back Monday after Sunday night’s “60 Minutes” interview in which Federal Reserve chairman Jerome Powell said, “We feel like we can approach the question of when to begin to reduce interest rates carefully,” and suggested a March rate cut was unlikely. The Dow Jones Industrial Average dropped 274.30 points, or 0.71%, to close at 38,380.12. The Standard & Poor’s 500 fell 15.8 points, or 0.32%, to close at 4,942.81. The Nasdaq Composite fell 31.28 points, or 0.2%, to close at 15,597.68.

- US crude oil prices were higher Monday. The March West Texas Intermediate light, sweet crude future was up 50¢ to close at $72.78 per barrel.

- US gold futures continued lower Monday after a four-day climb last week. The February contract subtracted $10.40 to close at $2,025.70 per oz.

Recap for February 2

- Shares of huge American technology companies — led by Meta, which added 20% after reporting its biggest quarterly sales increase in two years and initiated its first-ever dividend — propelled US equity indexes higher Friday, to a fourth straight week of gains, and to fresh record highs in two cases. Additional support came from a strong jobs report from the US government. The Dow Jones Industrial Average added 134.58 points, or 0.35%, to close at 38,654.42, its ninth record high of 2024. The Standard & Poor’s 500 added 52.42 points, or 1.07%, to close at 4,958.61. The Nasdaq Composite added 267.31 points, or 1.74%, to close at 15,628.95.

- The US dollar index soared Friday after a Department of Labor report indicated US employers added 353,000 jobs in January, more than double the expectations of a panel of analysts surveyed by the Wall Street Journal, and that the unemployment rate in January held steady at 3.7% (an increase was expected) and that wages jumped 4.5% in January from the same month a year earlier.

- The popping US dollar pressured US agricultural futures Friday. Soybeans closed lower under pressure from poor export demand exhibited in net export sales in the week ended Jan. 25 at 164,500 tonnes, representing the smallest weekly volume since May. Wheat complex futures were mixed with KC wheat firming despite improved Plains soil moisture profiles. Corn futures followed the day’s broad weakness lower to their seventh weekly decline in the past eight weeks. The March corn future dropped 4½¢ to close at $4.42¾ per bu. Chicago March wheat pared 1¾¢, closing at $5.99¾ per bu and the subsequent two contract also declined, but the September future and beyond mostly edged higher. Kansas City March wheat gained 4¼¢ to close at $6.25 per bu. Minneapolis March wheat added 3¾¢ for a second straight session, closing at $6.99¾ per bu. March soybeans declined 14¾¢ to close at $11.88½ per bu. March soybean meal pulled back $4.90 to close at $356.80 per ton. March soybean oil fell 0.87¢ to close at 44.73¢ a lb.

- US crude oil prices were lower again Friday. The March West Texas Intermediate light, sweet crude future was down $1.54 to close at $72.28 per barrel.

- US gold futures turned lower Friday after climbing for four days. The February contract subtracted $16.90 to close at $2,036.10 per oz.

Recap for February 1

- Wheat complex futures posted mixed closes Thursday with Minneapolis and front-end Chicago soft red winter contracts advanced in technical buying and short-covering moves. Kansas City hard red winter wheat futures declined Thursday as the US Department of Agriculture posted net export sales for the week ended Jan. 25 within pre-report expectations but down 29% from the previous week, down 9% from the four-week average and a three-week low. Soybean futures were also brought lower by export sales figures — at 64,500 tonnes in the week ended Jan. 25, it was the lowest weekly number for 2023-24 since the marketing year began Sept. 1 — and concerns about falling prices in competitor Brazil coupled with economic concerns for the world’s largest buyer, China. Corn futures tagged on to soybeans’ tumble with losses limited by strong export sales of 1.2 million in the latest reported week. The March corn future subtracted 1¢ to close at $4.47¼ per bu. Chicago March wheat added 6¼¢, closing at $6.01½ per bu, with gains diminishing through March 2025 and declining thereafter. Kansas City March wheat pulled lower by 1¼¢ to close at $6.20¾ per bu. Minneapolis March wheat climbed 3¾¢ to close at $6.96 per bu. March soybeans sank 19¢ to close at $12.03¼ per bu. March soybean meal shed $6.60 to close at $361.70 per ton. March soybean oil fell 0.42¢ to close at 45.60¢ a lb.

- Stocks posted a robust rebound Thursday from declines precipitated by ideas about the pace and starting point of the Federal Reserve’s interest rate cuts. The Dow Jones Industrial Average added 369.54 points, or 0.97%, to close at 38,519.84. The Standard & Poor’s 500 added 60.54 points, or 1.25%, to close at 4,906.19. The Nasdaq Composite added 197.63 points, or 1.30%, to close at 15,361.64.

- US crude oil prices were lower Thursday. The March West Texas Intermediate light, sweet crude future was down $2.03 to close at $73.82 per barrel.

- The US dollar index continued lower a third day Thursday.

- US gold futures advanced. The February contract added $4.60 to close at $2,053 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |