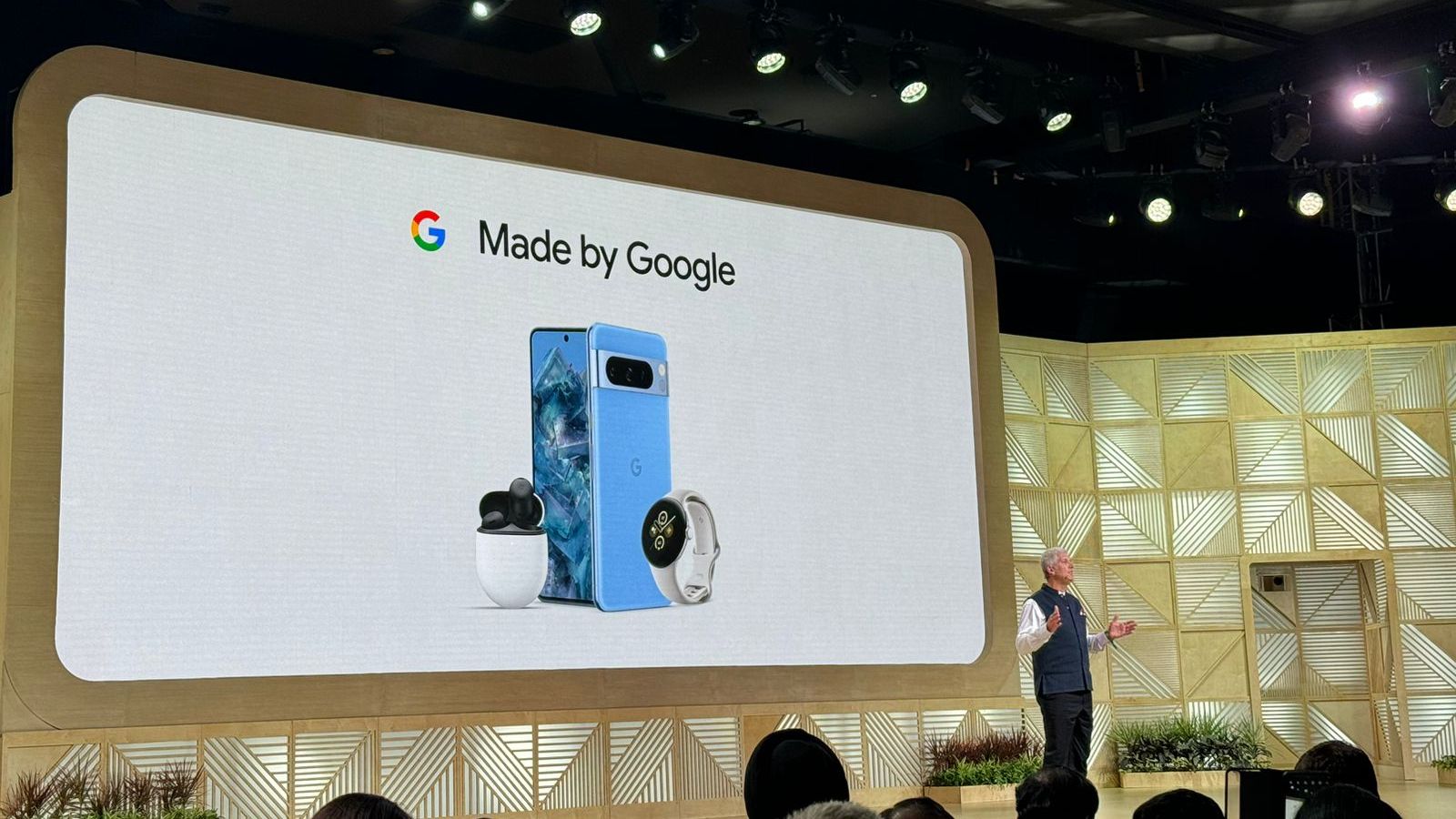

A video of Bollywood star Anil Kapoor donning his classic Mr India avatar, promoting the newest Pixel 8 series, was the highlight of Thursday’s Google for India event in New Delhi, followed by Google’s hardware honcho, Rick Osterloh, taking to the stage to announce that Pixel 8 smartphones would be manufactured in India for the first time. Maybe that’s what Google needed to cultivate a fan following for its premium Pixel phones in the world’s most populous country.

“Mainstreaming Pixel is certainly one of our goals in India,” Osterloh told indianexpress.com, adding that Google wants to scale its hardware business in the country and is focusing on long-term growth.

For years, Google has struggled to get it right with its Pixel brand in India, but the announcement that the company wants to start making the phones in the country next year could provide a boost to its hardware ambitions. Google has not shared more details on its manufacturing plans but said it will partner with international and domestic players to produce the smartphone locally.

But what many didn’t see coming was its decision to manufacture Pixel smartphones in India next year with the Pixel 8, not an A-series mid-range Pixel phone. For Osterloh, the acceptance of the A-series Pixel has had a lot to do with why Google is manufacturing its Pixel smartphones in India. “The A series has been wildly successful around the world, and the reason is that it provides an incredible value proposition for users,” he says. However, the move to make the Pixel 8 in India is aimed at tapping into the high-end smartphone segment.

India’s smartphone market is dominated by low-cost and mid-range Android smartphones made by Chinese players like Xiaomi, Oppo and Vivo, as well as South Korea’s Samsung. However, there has been significant growth in the premium smartphone segment. In fact, the premium smartphone segment contributed a record 17 per cent to the overall shipments in Q2 2023, according to Counterpoint Research. Apple, Samsung, OnePlus, and now Google, too, are eyeing the high-end smartphone segment where the average selling prices (ASPs) are high, and, therefore, there is more money to be made.

“The growth of the premium segment of the smartphone market is incredible,” he said in a select media briefing. “Its (India’s) transformation from being the eighth-largest premium market to the third within one year is truly remarkable. So, it’s undeniable how important it is for us because we have a product line that happens to be priced above a certain price point.”

Osterloh’s explanation that India’s premium smartphone market is expanding and there is an opportunity for Google to target aspirational, young consumers who have the means to purchase premium Pixel phones mirrors what Apple has done in recent months. Apple is also ramping up local manufacturing as well as distribution and marketing efforts in the world’s fifth-largest economy.

Osterloh, who was previously with Motorola and joined Google as Senior VP of Devices and Services in 2016, has been instrumental in building the Pixel brand. The original Pixel from 2016 and the Pixel 2 from 2017 received favourable reviews. However, it was the Pixel 3 and Pixel 3 XL that had a profound impact on the smartphone market with their cameras. Pixel smartphones continue to feature impressive cameras, but the search engine giant now markets its Google-branded phones as AI mobile computers.

“The market is growing so rapidly, and the nature of AI and the significant computing capabilities required to deliver it mean that our product line is a great fit for the market here,” says Osterloh.

“It’s a positive direction to start with the Pixel 8 base version, as Google would look to save on import duties and pass those savings on to consumers, making it more price competitive,” said Neil Shah, a partner at Counterpoint Research. However, he said Google needs to work on expanding its channels and improving pre-and post-sales support to drive success in India.

Alphabet, Google’s parent company, doesn’t break out numbers for Osterloh’s group but reportedly the company has shipped 40 million Pixel smartphones since launch.

Most Read

India vs Bangladesh Live Score, World Cup 2023: IND bowlers restrict BAN to 256/8

Amitabh Bachchan refused to wear topor at Bengali wedding with Jaya Bachchan, told her parents, ‘I will marry your daughter but…’

Part of the move, whether it is Google or Apple, is tied to the government’s push to bring high-tech manufacturing to the country. Google has been bullish on India for long with its core apps and services, and now the company is ramping up sales and manufacturing of its flagship Pixel phone in the country.

“Mobile manufacturing was particularly negligible nine years back. Today, it is worth $44 billion and the export of mobile phones is $11 billion,” Ashwini Vaishnaw, Minister for Railways, Communications, Electronics & Information Technology, Government of India, said, addressing the audience during the Google for India event. India wants to be seen as an alternative to China in the manufacturing of smartphones, and New Delhi’s strategy is to attract companies like Google and Apple to produce their devices in the country.

For Shah, Google’s deep expertise in search and Generative AI will be key differentiators to sell its Pixel smartphones in the country. Google has a real chance to compete more effectively with OnePlus and Samsung in the Rs 25,000 to Rs 45,000 segment with its cleaner software, long-term security and software updates, and camera prowess.

Source link

credite