Market scorecard

US markets closed in the red again yesterday after fell to a four-month low. Both the S&P 500 and slumped by 1.5% with the rising to its highest level since May. Perhaps the members of the Fed will notice that their rate hikes are hitting consumer sentiment, so it’s time to stop? We can only hope.

Long-term investors such as ourselves know to keep our heads down at times like these, and wait for better days.

In company news, online retailer Amazon (NASDAQ:) dropped by 4% after the Federal Trade Commission (FTC) filed a lawsuit alleging that the company wields illegal monopoly power. That’s nonsense, ignore this, the FTC is run by idiots. Elsewhere, Cintas (NASDAQ:), the Cincinnati-based company known for uniform rental and related services was the biggest loser in the S&P 500, dropping 5.3%. The company shared poor revenue guidance that upset shareholders.

In summary, the JSE All-share closed down 1.02%, the fell 1.47%, and the was 1.57% lower. An ugly day, that’s for sure.

One thing, from Paul

Nick Huber is a business owner on Twitter with the user name @SweatyStartup. He likes to be provocative and writes about sticking to the basics when making money, avoiding nonsense activities, and working smart.

In a recent newsletter, he compares the two kinds of customers that businesses often encounter. (1) customers who think a product that costs $10k is absurdly expensive. (2) customers who think a product that costs $10k is absurdly cheap. The key is finding enough of that second type to build a good company.

Huber’s advice: “You cannot make real money working for the first. You cannot scale a business working for the first. You cannot afford to hire good management to make decisions and grow the company working for the first”.

He gives some examples of what happens with those two kinds of customers:

Cheapskate customer: “Can you come early? I have a little extra I need you to do as well. Can you stay longer? This didn’t work out as well as I expected I need to talk about the bill. Can you call me please right away we have a major problem!”

High-end customer: “Send invoice. Thx.”

Huber again: “The key to building a successful company: (1) raise your prices, and (2) find customers who are willing to pay those higher prices and tell the ones who aren’t to go find a cheaper, sh1ttier option”.

I was thinking about this story when considering some of the companies that we invest in. I like Apple (NASDAQ:) because they have this attitude. So do Nvidia (NASDAQ:), Stryker (NYSE:), Starbucks (NASDAQ:) and Nike (NYSE:). They sell premium products and services, at premium prices. If you don’t want to pay up, go elsewhere.

Bright’s banter

In 2012, Novo Nordisk (CSE:), a Danish pharmaceutical giant, developed a medication called semaglutide, designed to help manage type 2 diabetes. This injectable drug, later marketed as Ozempic, was approved by the FDA in 2017. Interestingly, while users reported various side effects, including nausea, some also experienced significant weight loss as an unintended consequence.

Fast forward to today, Novo Nordisk’s rebranded version of semaglutide, called Wegovy, was approved by the FDA for chronic weight management, and Ozempic has become something of a Hollywood secret. Celebrities like Jimmy Kimmel have even mentioned it.

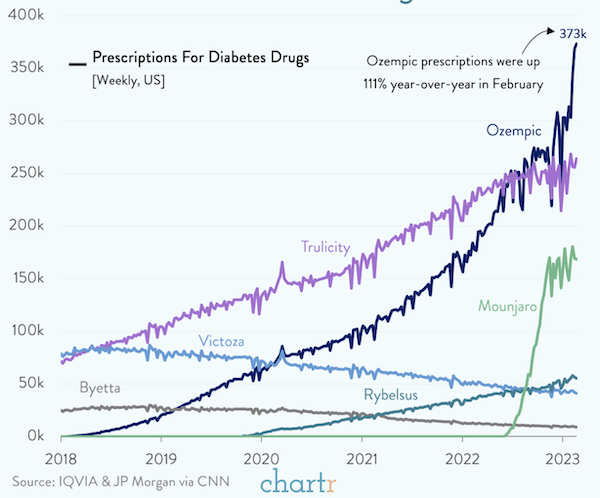

Ozempic is technically approved only for diabetes treatment, but prescriptions have skyrocketed. In 2018, there were fewer than 100 US Ozempic prescriptions per week, but by 2020, this number exceeded 100,000. Doctors are increasingly prescribing Ozempic “off-label” for weight loss.

But Ozempic isn’t the only diabetes drug experiencing high demand. Mounjaro which is produced by Eli Lilly (NYSE:), has also seen a surge in popularity, because it’s touted as the most potent in terms of slimming potential. Eli Lilly is seeking FDA approval for Mounjaro as a weight loss medication by the end of 2023.

The rise in the use of these medications coincides with the growing obesity rates in the United States. According to the CDC, obesity has increased significantly since the 1960s, affecting both men and women. Factors like dietary choices, increased sugar and ultra-processed food consumption, and a sedentary lifestyle are often cited as contributing to this epidemic. Obesity-related costs are substantial, reaching approximately $260 billion annually, leading many to seek a “magic solution.”

Social media has played a significant role in amplifying the hype surrounding these drugs, with videos tagged #ozempic alone garnering over 1.2 billion views on TikTok. This surge in popularity has even led to a shortage of these drugs, leaving some diabetic patients without their necessary medication.

While weight loss drugs like Ozempic, Wegovy, and Mounjaro have gained popularity, their high costs (with courses of Mounjaro and Wegovy ranging from $12,000 to $16,000 in the US) limit their accessibility. Interestingly, they are much cheaper here in South Africa.

Despite the buzz, the longevity of these weight loss drugs in the market remains uncertain. Similar to past dieting trends like Atkins, paleo, and keto diets, their popularity may eventually wane. However, it appears that when people stop taking these drugs they put the weight back on. So this probably won’t be a passing fad, and the pharmaceutical industry is investing heavily to meet the growing demand.

If you want exposure to these companies in your portfolio, we suggest Eli Lilly. US-based companies trade on higher multiples to their earnings than European ones.

Signing off

The index has fallen for a third straight session. Japanese and South Korea markets are lower. Chinese markets are up a bit, because data out today suggests that China’s industrial sector is showing some resilience.

US equity futures have also ticked higher in early trade. The is trading at around R19.07 to the US Dollar.

It’s overcast in Joburg today, hopefully it’s the start of our summer rains.

Have a good day.

Original Post

Source link

credite