American Airlines has loaded a schedule that pulls down about half the routes from its Austin focus city, as first reported by Adrian Waltz based on data available in Cirium’s Diio Mi. Eliminated in the schedule load were 21 out of American’s 46 destinations from Austin.

The latest Diio update had the following adds (Green), and removals (Red) of domestic routes by major carriers this week. pic.twitter.com/1vBJEPNbDd

— AdrianWaltz (@AdrianWaltz) November 4, 2023

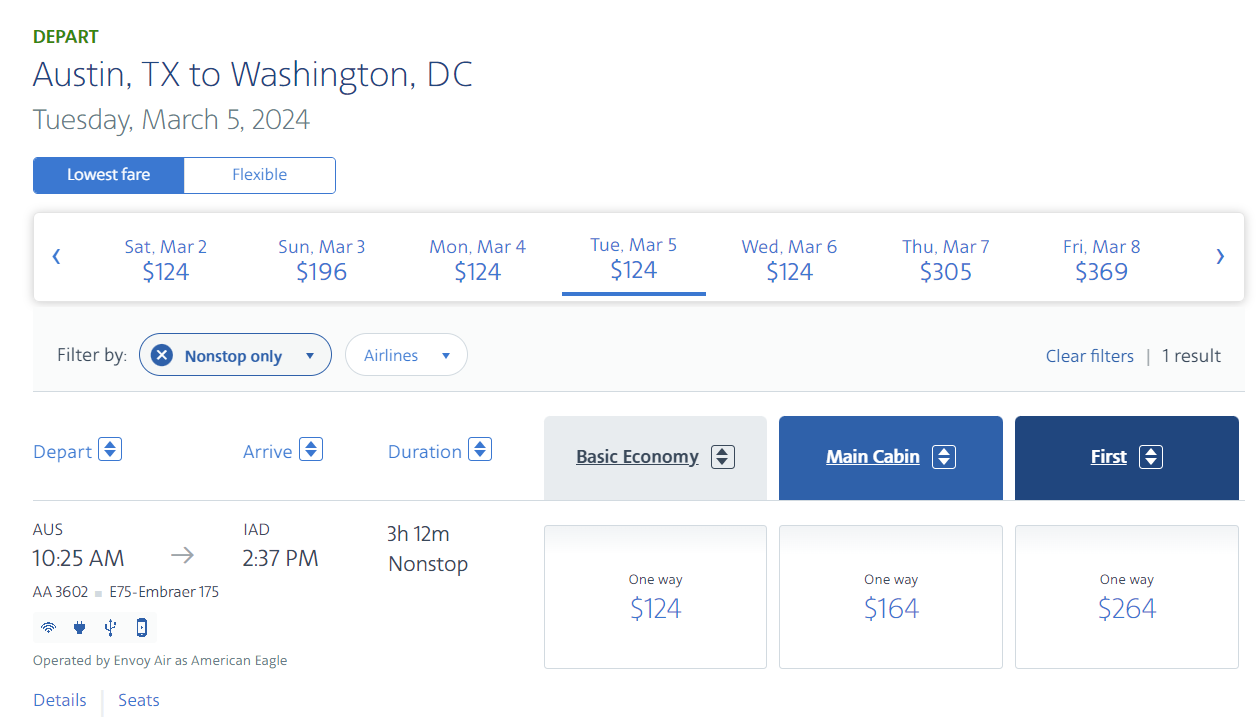

However, American Airlines is still selling some of these. Here’s Washington Dulles:

Dulles airport in particular is a flight that’s come and go from American’s Austin schedule over the past couple of years. It was once two daily Airbus A319s, and at times where it’s operated it’s been down to a non-daily regional jet. Every time the flight seems to gain traction it disappears from the schedule.

The airline began building up a significant focus city in Austin during the pandemic. In 2019 they flew to 8 cities from the Texas capital. That’s grown several-fold.

- Austin has been the fastest-growing, or in some cases second-fastest growing, airport in the country several years in a row.

- Delta had announced it as a focus city, but was slow in building its operation there. Austin and Raleigh are Delta’s only remaining focus cities and Delta is finally building modestly in Austin.

- Austin’s airport is heavily gate-constrained. Despite adding 37% more gates in 2018, common use gates are fully utilized. They’re building 3 new gates as part of a ‘West Gate Expansion’ that should complete in 2026, but those gates merely allow taking 3 other gates offline to build a connector to a planned new midfield concourse.

And the main terminal will have to accommodate Frontier and Allegiant, which are being displaced from the airport’s low cost terminal, which will be torn down as part of concourse expansion plans. The new concourse is still in pre-design, so net gate growth won’t occur until the 2030s.

- During peak times the terminal is so crowded that it can be difficult to traverse – think the end of concourses in Charlotte.

American’s expansion blocked growth by other airlines. But flight growth outpaced passenger growth, and with corporate travel still on a lower trajectory than pre-pandemic yields out of the city have been awful. Already we’ve seen several routes cancelled, though that’s natural – not everything will work. Some of the worst-performing have been San Juan and the Caribbean.

They cancelled the Reno flight I took last month. Virgin Atlantic announced the cancellation of Austin – London Heathrow. Austin couldn’t support two London flights (alongside BA) and the one without meaningful connecting feed on either side (and supported by Delta’s smaller Austin customer base) didn’t make it.

What’s going on, loading a schedule without 21 routes but actually still selling many of the flights?

American Airlines joint venture partner Qantas, on whose board ex-American Airlines CEO Doug Parker serves, is caught up in a scandal in Australia over selling tickets for flights they’d already decided to cancel. The airline is being roundly mocked for its legal claim that they do not sell seats on particular flights, merely a ‘bundle of rights’ that permits passengers to buy tickets and Qantas to keep their money whether or not the specific flight operates.

Enilria suggests that American may have made a mistake loading its schedule changes, intending to reduce frequencies but not as much as they initially did, or that the removal was premature – preparing for messaging of such a major reduction.

Austin has frequently been a cheap place to connect on American Airlines, due to light loads on many of their flights. Austin connections have also been inexpensive AAdvantage redemptions for the same reason. But that doesn’t just mean Austin performs poorly. It also drags down yields on American’s other flights, especially connections through Dallas – Fort Worth.

American has also delayed plans for a new Admirals Club. In 2021 they announced a new Austin club, including the first renderings of the new Admirals CLub design template. But they never began the project, instead entering discussions to locate one in new expansion space that the airport is building. As a result it appears we won’t see a new club in Austin until at least 2026.

Some of these routes are seasonal. Some of these flights may not be gone entirely, and some of the frequencies dropped could have been unintentional – a schedule misfile. American’s schedule also isn’t firm more than 90 days out in any case.

We’ve also seen a dizzying series of updates to Austin flying, with destinations dropped and re-added to the point where I frequently don’t know what cities American is selling from my home airport. These get added and removed from their schedule without comment. Passengers are just supposed to know them when they see them searching for travel.

Removing 21 destinations, though, might give other airlines an opportunity to grow in Austin – a reason on its own to consider squatting on current gates as the city grows into its expanded air service.

Update: In addition to losing money in Austin, the operation has been heavily regional jet-focused to many destinations. Apparently American Airlines has had regional carriers operating more than their mainline pilot union contract allows (“scope”). The airline has talked about keeping regional jets grounded.

American’s pilot scope clause limits them to flying regional jets with 66-76 seats to no more than 40% of their mainline narrowbody fleet. Retirements of Boeing 757 and Embraer E-190 fleets reduced the size of the mainline narrowbody fleet, limiting the number of 66+ seat regional jets. In the past they’ve operated Embraer E-175s with 65 seats instead of 76 seats to maintain compliance.

Note though that American’s Austin cuts include flights operated by Airbus A319s (mainline narrowbodies) as well. But the volume of regional jet cuts, focused on an unprofitable operation, make sense. From aviation watchdog JonNYC, who also says that the flights are officially cancelled even though they’re still for sale on the airline’s website.

AA not making money out of Austin is the reason for these cuts. Full stop.

There is this going on at the same time: pic.twitter.com/yBLCjucsV4— JonNYC (@xJonNYC) November 4, 2023