Recap for March 5

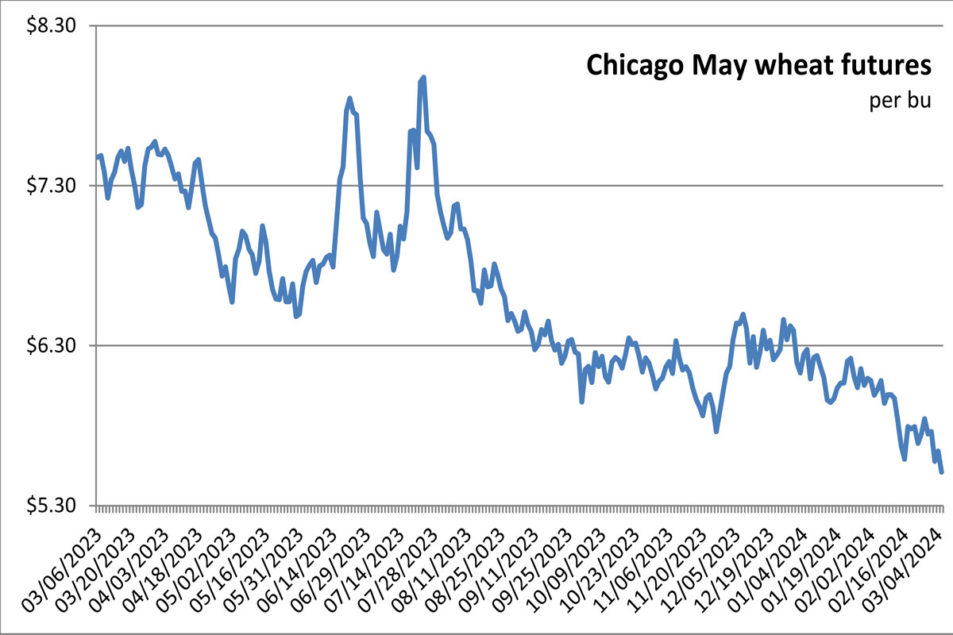

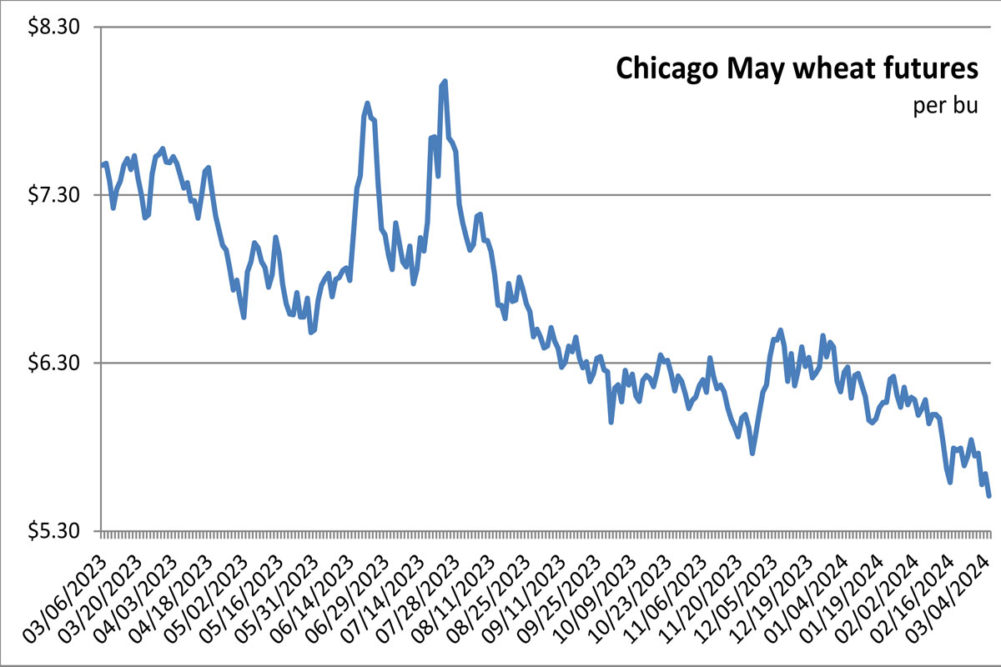

- Corn, soybean and wheat futures could not sustain overnight bargain-buying rises and dropped lower Tuesday. Corn and soybeans hovered near three-year lows ahead of Friday’s updated supply and demand numbers from the US Department of Agriculture. Soybeans were under pressure from increased fund selling. Wheat tumbled alongside declining European wheat futures amid weakening prices in the Black Sea, believed to be the winning origin from Algeria’s tender. The May corn future lost 3¾¢ to close at $4.26¼ per bu. Chicago May wheat dropped 13¢ to settle at $5.51 per bu. Kansas City May wheat fell 11¢ to close at $5.69¼ per bu. Minneapolis May wheat dropped 4¢ but closed at $6.55½ per bu. May soybeans were down 6¢ to close at $11.49 per bu. May soybean meal shed $3.60 to close at $329.90 per ton. May soybean oil eased 0.13¢ to close at 45.04¢ a lb.

- The Magnificent Seven stocks of gigantic tech companies, save for Nvidia, all pulled lower Tuesday, dragging major equity markets further from recent record highs. Trading was cautious ahead of key data coming from the government, including a jobs report Friday. The Dow Jones Industrial Average fell 404.64 points, or 1.04%, to close at 38,585.19. The Standard & Poor’s 500 gave back 52.3 points, or 1.02%, to close at 5,078.65. The Nasdaq Composite sank 267.92 points, or 1.65%, to close at 15,939.59.

- US crude oil prices declined again Tuesday. The April West Texas Intermediate light, sweet crude future dropped 59¢ to close at $78.15 per barrel.

- The US dollar index closed lower for a third consecutive trading day Tuesday.

- US gold futures advanced again Tuesday. The April contract added $15.60 to close at $2,141.90 per oz.

Recap for March 4

- Corn and soybean futures closed higher Monday in bargain buying off of recent three-year lows and short-covering moves. Gains were limited by ample supplies in South America. Wheat complex futures brushed aside bearish Russian wheat prices and Australian wheat crop news Monday and closed higher in a round of short covering alongside corn and soybean futures. The May corn future added 5¼¢ to close at $4.30 per bu. Chicago May wheat added 6¼¢ to settle at $5.64 per bu. Kansas City May wheat added 15¾¢ to close at $5.80¼ per bu. Minneapolis May wheat also was up 15¾¢ but closed at $6.59½ per bu. May soybeans advanced 3¾¢ to close at $11.55 per bu. May soybean meal added $1.20 to close at $333.50 per ton. May soybean oil edged up 0.01¢ to close at 45.17¢ a lb.

- US equity indices faltered Monday, weighed down by declines in shares of six of the Magnificent Seven stocks: Alphabet, Amazon, Apple, Meta Platforms, Microsoft and Tesla. The seventh, Nvidia, surged 3.6% following Friday’s first-time close above $2 trillion market valuation. The Dow Jones Industrial Average fell 97.55 points, or 0.25%, to close at 38,989.83. The Standard & Poor’s 500 fell 6.13 points, or 0.12%, to close at 5,130.95. The Nasdaq Composite dropped 67.43 points, or 0.41%, to close at 16,207.51.

- US crude oil prices declined Monday. The April West Texas Intermediate light, sweet crude future dropped $1.23 to close at $78.74 per barrel.

- The US dollar index closed lower for a second session Monday after moving higher most of last week.

- US gold futures advanced again Monday. The April contract jumped $30.60 higher to close at $2,126.30 per oz.

Recap for March 1

- Ample Black Sea supplies and tumbling Russian wheat prices weighed on the wheat complex at the end of the week. Spillover weakness brought corn futures lower Friday. Soybean futures turned higher at the end of the week on bargain buying and short covering after hitting three-year lows a day earlier. Gains were limited by lackluster exports and large global supplies. The May corn future fell 4¾¢ to close at $4.24¾ per bu. Chicago May wheat dropped 18½¢ to settle at $5.57¾ per bu. Kansas City May wheat sank 22¾¢ to close at $5.64½ per bu. Minneapolis May wheat was down 15¼¢ to close at $6.43¾ per bu. May soybeans jumped 10½¢ to close at $11.51¼ per bu. May soybean meal added $3.10 to close at $332.30 per ton. May soybean oil eased 0.05¢ to close at 45.16¢ a lb.

- US equity indices posted gains Friday. Soaring shares of Nvidia pushed the artificial-intelligence-focused tech giant’s market valuation above $2 trillion Friday. The S&P 500 index notched a 15th fresh record high of 2024 and its 16th weekly gain in the past 18 weeks, a streak not seen in 53 years. The Dow Jones Industrial Average added 90.99 points, or 0.23%, to close at 39,087.38. The Standard & Poor’s 500 added 40.81 points, or 0.80%, to close at 5,137.08. The Nasdaq Composite jumped 183.02 points, or 1.14%, to close at 16,274.94.

- US crude oil prices flipped and closed higher Friday. The April West Texas Intermediate light, sweet crude future added $1.71 to close at $79.97 per barrel.

- The US dollar index closed lower Friday, snapping a three-day win streak.

- US gold futures advanced again Friday. The April contract surged $41 higher to close at $2,095.70 per oz.

Recap for February 29

- The Nasdaq index on Thursday notched its first fresh record high since 2021, ending its streak of 569 trading days without one. The other two major equity indexes also were higher with support from shares of Hormel Foods, which was up 14% after earnings topped expectations. Advanced Micro Devices crossed the $300 billion market value line for the first time. The Dow Jones Industrial Average added 47.37 points, or 0.12%, to close at 38,996.39. The Standard & Poor’s 500 added 26.51 points, or 0.52%, to close at 5,096.27. The Nasdaq Composite jumped 144.18 points, or 0.90%, to close at 16,091.92.

- Improving South American weather sent US soybean futures to a three-year low Thursday with further pressure provided by lackluster US export sales and heavier-than-expected contract deliveries. Corn futures were mixed in volatile technical trading. US wheat futures were mostly higher Thursday, although deferred soft wheat contracts slipped under pressure from a stronger dollar, spillover weakness from corn and soybeans, and stiff global export competition. The May corn future added 1¢ to close at $4.29½ per bu. Chicago May wheat added 1½¢ to settle at $5.76¼ per bu; later months were mixed. Kansas City May wheat added 6¼¢ to close at $5.87¼ per bu. Minneapolis May wheat was up 3¢ to close at $6.59 per bu. May soybeans fell 4½¢ to close at $11.40¾ per bu. May soybean meal added $1.70 to close at $329.20 per ton with later months mixed. May soybean oil edged up 0.02¢ to close at 45.21¢ a lb.

- US crude oil prices closed lower again Thursday. The April West Texas Intermediate light, sweet crude future fell 28¢ to close at $78.26 per barrel.

- The US dollar index closed higher for a third straight session Thursday.

- US gold futures advanced Thursday. The April contract added $12 to close at $2,054.70 per oz.

Recap for February 28

- Signals of ample supplies of grain in the Black Sea region, including in Ukraine where February grain shipments to date were up 12% year over year, weighed on wheat futures Wednesday. Corn futures advanced modestly in recovery mode after recently touching three-year lows. And soybean futures were higher in short covering moves and technical buying Wednesday. The May corn future added 5¢ to close at $4.28½ per bu. Chicago May wheat fell 9½¢ to settle at $5.74¾ per bu. Kansas City May wheat dropped 4¾¢ to close at $5.81 per bu. Minneapolis May wheat shed 6¼¢ to close at $6.56 per bu. May soybeans advanced 4½¢ to close at $11.45¼ per bu. May soybean meal added $2.60 to close at $327.50 per ton. May soybean oil fell 0.25¢ to close at 44.66¢ a lb.

- US equity markets declined Wednesday under pressure from declining shares of enormous tech companies such as Apple and Alphabet as investors awaited fresh inflation data coming Thursday. The Dow Jones Industrial Average dropped 23.39 points, or 0.06%, to close at 38,949.02. The Standard & Poor’s 500 shed 8.42 points, or 0.17%, to close at 5,069.76. The Nasdaq Composite fell 87.56 points, or 0.55%, to close at 15,947.74.

- US crude oil prices closed lower Wednesday. The April West Texas Intermediate light, sweet crude future shed 33¢ to close at $78.54 per barrel.

- The US dollar index closed higher for a second day Wednesday on the heels of an eight-day losing streak.

- US gold futures declined Wednesday. The April contract dropped $1.40 to close at $2,042.70 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |