Receive free Equities updates

We’ll send you a myFT Daily Digest email rounding up the latest Equities news every morning.

The dollar strengthened and US government debt sold off on Friday as investors reacted to data that offered a mixed reading on the strength of the US economy.

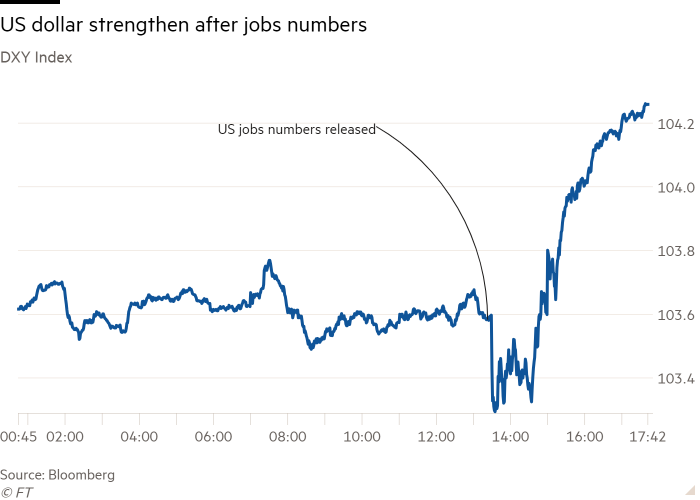

The dollar index, a measure of the currency’s strength against a basket of six peers, gained 0.5 per cent after the release of August’s jobs numbers, which showed that the unemployment rate rose 0.3 percentage points last month to an 18-month high of 3.8 per cent. Economists had forecast an increase to just 3.5 per cent.

In contrast, last month’s US employment numbers were stronger than expected, with non-farm payrolls increasing by 187,000, more than the 170,000 expected by economists polled by Reuters. However, the change in non-farm payroll employment for June and July was revised lower by 80,000 and 30,000, respectively.

Longer-dated government bonds sold off, with the yield on the 10-year Treasury up 0.1 percentage point to 4.19 per cent. Yields rise when prices fall.

Friday’s figures suggested that labour market conditions were “normalising” and raised the chances that the Fed’s next move would be an interest-rate cut in the first half of the year, said Andrew Hunter, deputy chief US economist at Capital Economics.

“The soft-landing scenario will not be dismissed by this job report,” said Florian Ielpo, head of macro at Lombard Odier Asset Management. “It strikes a nice balance between good and bad news.”

But market optimism was punctured later by hawkish comments from Loretta Mester, president of the St Cleveland Fed, who said inflation “remains too high”.

Stock markets retreated after rising in morning trade. The benchmark S&P 500 was flat at midday in New York, while the tech-heavy Nasdaq Composite fell 0.2 per cent, erasing an earlier 0.6 per cent advance.

The state of the US labour market has become a concern for investors and economists in recent months as the world’s biggest economy continued to add jobs and report higher wages despite the Fed’s aggressive monetary tightening campaign.

However, figures out this week suggest that the jobs market may be beginning to cool. Job openings in July fell to the lowest level in more than two years. The futures market is now pricing in a 90 per cent chance that the Fed leaves rates unchanged when it meets later this month.

Elsewhere, Europe’s Stoxx 600 index was flat, while Germany’s Dax fell by 0.7 per cent. The moves came a day after eurozone core inflation, which excludes volatile energy and food prices and is closely watched by the European Central Bank, fell to 5.3 per cent in August from 5.5 per cent in July.

London’s FTSE 100 rose 0.3 per cent, led by energy and basic material groups including BP, Shell and Glencore.

In Asia, meanwhile, China’s CSI 300 gained 0.7 per cent after an unexpected increase in Chinese manufacturing activity last month.

In commodity markets, Brent crude, the international benchmark, added 1.7 per cent to trade at $88.26 a barrel after Russia signalled support for further supply cuts.