Recap for November 22 (Markets were closed for the Thanksgiving holiday.)

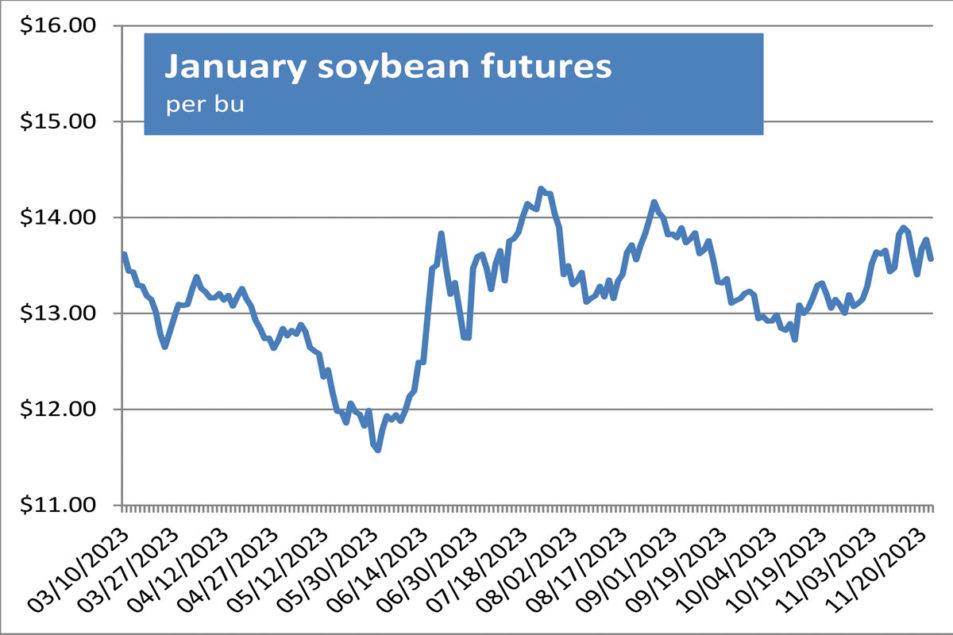

- Chicago grain and soy complex futures mostly closed lower Wednesday ahead of the Thanksgiving holiday. Chicago wheat futures edged higher with support from a new sale of soft red winter wheat to China. Minneapolis wheat futures were lower. KC wheat futures were narrowly mixed. Corn futures edged lower on positioning ahead of the holiday, with support from fresh export sales reported by the USDA offset by favorable rain in Brazil. Underpinning grain futures were reports of new attacks by Russia on Ukraine’s key Black Sea port of Odesa. Soybean futures also were pressured by much-needed rain in Brazil. Futures markets will be closed Thursday but will be open for an abbreviated session on Friday. December corn futures eased 1¼¢ to close at $4.68¾ per bu. Chicago December wheat added ¾¢ to close at $5.55¾ per bu. Kansas City December wheat lost 1¼¢ to close at $6.14½ per bu with later months narrowly mixed. Minneapolis December wheat fell 6¾¢ to close at $7.10¾ per bu. January soybeans fell 20¾¢ to close at $13.56½ per bu. December soybean meal lost $1.10 to close at $458.10 per ton. December soybean oil dropped 0.59¢ to close at 53.60¢ a lb.

- US equity markets closed higher Wednesday ahead of the Thanksgiving break on traders’ hopes that the Federal Reserve was finished raising interest rates and the economy remained strong. The Dow Jones Industrial Average added 184.74 points, or 0.53% to close at 35,273.03. The Standard & Poor’s 500 gained 18.43 points, or 0.41 to close at 4,556.62. The Nasdaq Composite rose 65.88 points, or 0.46%, to close at 14,265.86.

- US crude oil prices declined Wednesday. The January West Texas Intermediate light, sweet crude future was down 67¢ at $77.10 per barrel.

- The US dollar index closed higher Wednesday for a second day after posting declines for most of the previous two weeks.

- US gold futures declined Wednesday; the December contract fell $8.80 to close at $1,992.80 per oz.

Recap for November 21

- Corn futures ended slightly higher on Tuesday as the market reacted to Brazil’s weather woes and Argentina’s presidential election. Wheat futures climbed Tuesday after a Ukrainian official said Russian forces struck port infrastructure on one of the nation’s key export routes in the southern city of Odesa. Soybean futures ended higher on Tuesday as Brazil’s crop-threatening weather conditions remained a prime worry for the market, despite rain the last couple of days. December corn futures added ½¢ to close at $4.70 per bu. Chicago December wheat added 11½¢ to close at $5.55 per bu. Kansas City December wheat added 5¼¢ to close at $6.15¾ per bu. Minneapolis December wheat jumped 10¼¢ to close at $7.17½ per bu. January soybeans climbed 10¢ to close at $13.77¼ per bu. December soybean meal fell $1 to close at $459.20 per ton; later months were mixed. December soybean oil added 1.08¢ to close at 54.19¢ a lb.

- US equity markets, buoyed Monday by tech stocks that included artificial intelligence companies, closed lower Tuesday as those same shares tested the strength of the November rally. The Dow Jones Industrial Average fell 62.75 points, or 0.18%, to close at 35,088.29. The Standard & Poor’s 500 eased 9.19 points, or 0.2%, to close at 4,588.19. The Nasdaq Composite fell 84.55 points, or 0.59%, to close at 14,199.98.

- US crude oil prices were mixed Tuesday. The January West Texas Intermediate light, sweet crude future was down 6¢ at $77.77 per barrel, but forward months edged higher.

- The US dollar index closed higher Tuesday for just the second time in the past eight trading days.

- US gold futures advanced; the December contract up $21.30 to close at $2,001.60 per oz.

Recap for November 20

- Boosted by scorching conditions and weekend rains in Brazil and the results of the Argentina presidential election, US soybean futures rose 2% on Monday. Brazil’s weather situation and confirmed export sales to Mexico sent corn futures higher. Expectations the USDA would leave unchanged its weekly condition ratings for US winter wheat, which was off to its best start in years, weighed on wheat futures Monday, sending Chicago and Kansas City futures to contract lows. After the close, the USDA said winter wheat rated good-to-excellent was up one percentage point from a week earlier. December corn futures added 2½¢ to close at $4.69½ per bu. Chicago December wheat fell 7¼¢ to close at $5.43½ per bu. Kansas City December wheat declined 7½¢ to close at $6.10½ per bu. Minneapolis December wheat fell 8¼¢ to close at $7.07¼ per bu. January soybeans jumped 27¢ to close at $13.67¼ per bu. December soybean meal added $6.90 to close at $460.20 per ton. December soybean oil added 1.10¢ to close at 53.11¢ a lb.

- US equity markets closed higher Monday, boosted by shares of technology companies working on artificial intelligence, such as Microsoft and Nvidia. The Dow Jones Industrial Average added 203.76 points, or 0.58%, to close at 35,151.04. The Standard & Poor’s 500 added 33.36 points, or 0.74%. The Nasdaq Composite ascended 159.05 points, or 1.13%, to close at 14,284.53.

- US crude oil prices were higher Monday. The expiring December West Texas Intermediate light, sweet crude future was up $1.71 at $77.60 per barrel, and the January contract was up $1.79 to close at $77.83 per barrel.

- The US dollar index closed lower Monday for the sixth time in seven trading days.

- US gold futures eased; the December contract down $4.40 to close at $1,980.30 per oz.

Recap for November 17

- The prospect of rain in drought-stricken Brazil weighed on grain and oilseed futures Friday as traders exited long positions heading into a shortened Thanksgiving trading week. Soybeans and corn dropped more than 1%. Wheat prices were near September’s three-year low of $5.40 as Russia continued to export huge amounts of cheap grain as it wrapped up a second consecutive bumper crop. December corn futures fell 7¾¢ to close at $4.67 per bu. Chicago December wheat dropped 2¾¢ to close at $5.50¾ per bu. Kansas City December wheat declined 9¼¢ to close at $6.18 per bu. Minneapolis December wheat fell 10½¢ to close at $7.15½ per bu. January soybeans dropped back 20¢ to close at $13.40¼ per bu. December soybean meal eased $13.50 to close at $453.30 per ton. December soybean oil added 0.38¢ to close at 52.01¢ a lb.

- US equity markets closed higher for a third straight week Friday, indicating US investors had regained their appetite for risk three days after a cooler-than-expected inflation report indicated a soft landing might be in store versus a steep recession. The Dow Jones Industrial Average edged up 1.81 points, or 0.01%, to close at 34,947.28. The Standard & Poor’s 500 added 5.78 points, or 0.13%, to close at 4,514.02, for a 2.2% weekly gain. The Nasdaq Composite ascended 11.81 points, or 0.08%, to close at 14,125.48.

- US crude oil prices were higher Friday. The December West Texas Intermediate light, sweet crude future was up $2.99 at $75.89 per barrel.

- The US dollar index closed lower Friday for the fifth time in six trading days.

- US gold futures eased despite the downturned dollar. The December contract fell $2.60 to close at $1,984.70 per oz.

Recap for November 16

- Rainy Brazilian forecasts and the possibility of downpours that could offset the export competitor’s recent hot, dry weather weighed on soybean futures Thursday. Corn dipped early in the session but closed slightly higher. Wheat futures were lower, down 1.25% to two-week lows in the case of Chicago soft red winter wheat, on weak demand. December corn futures added 4¢ to close at $4.74¾ per bu. Chicago December wheat dropped 7¢ to close at $5.53½ per bu. Kansas City December wheat dropped 12½¢ to close at $6.27¼ per bu. Minneapolis December wheat fell 9¼¢ to close at $7.26 per bu. January soybeans tumbled 24¾¢ to close at $13.60¼ per bu. December soybean meal eased $2.40 to close at $466.80 per ton. December soybean oil lost 1.42¢ to close at 51.63¢ a lb.

- US equity markets were mixed, the S&P 500 and Nasdaq edging higher while the DJIA dipped under pressure from earnings selloffs on such shares as Cisco Systems and Walmart. The Dow Jones Industrial Average dropped 45.74 points, or 0.13%, to close at 34,945.47. The Standard & Poor’s 500 edged up 5.36 points, or 0.12%, to close at 4,508.24. The Nasdaq Composite edged up 9.84 points, or 0.07%, to close at 14,113.67.

- US crude oil prices were lower Thursday. The December West Texas Intermediate light, sweet crude future was down $3.76 at $72.90 per barrel.

- The US dollar index reverted to its recent downside slide Thursday after a one-day reprieve Wednesday.

- US gold futures jumped as the dollar dipped Thursday. The December contract added $23 to close at $1,987.30 per oz.