Recap for February 12

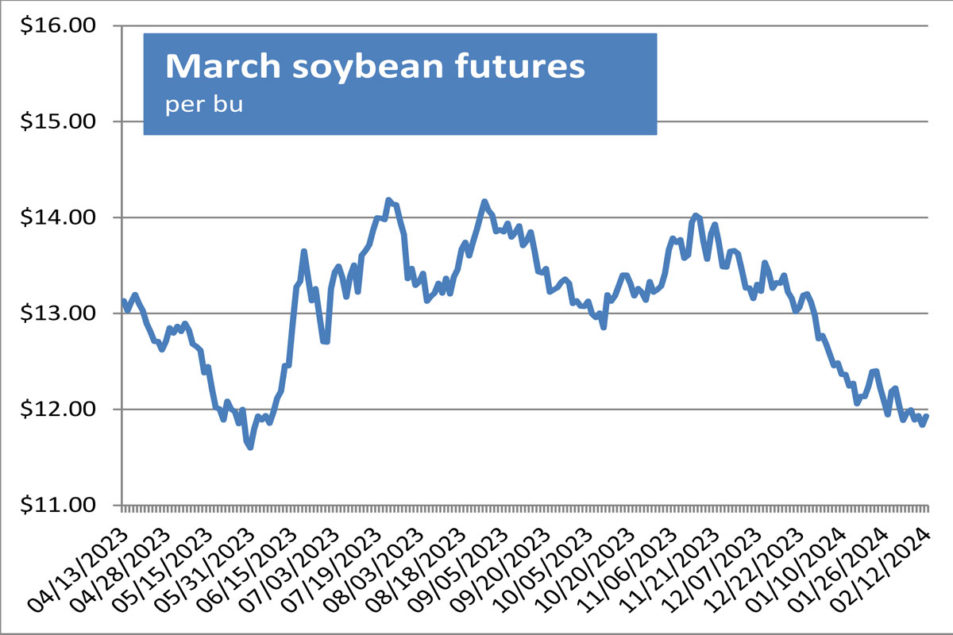

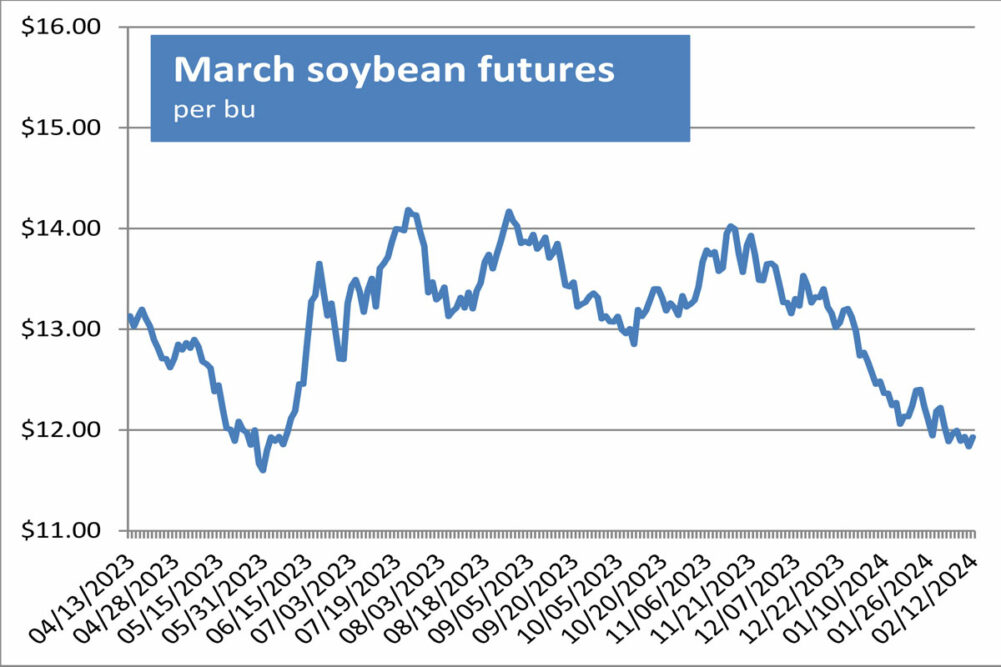

- Soybean futures jumped higher Monday in a round of bargain buying off of last week’s three-year lows. Corn futures also notched bargain-buying gains to a lesser degree. Wheat complex futures were mixed, mostly lower, on ongoing global export price competition and weak export demand for US supplies. The March corn future added 1½¢ to close at $4.30½ per bu. Chicago March wheat added ¾¢, closing at $5.97½ per bu though most later months eased. Kansas City March wheat fell 2¾¢ to close at $5.98¾ per bu. Minneapolis March wheat fell 1¾¢ to close at $6.82½ per bu. March soybeans jumped 9½¢ to close at $11.93 per bu. March soybean meal added $2.10 to close at $348.90 per ton. March soybean oil declined 0.36¢ to close at 46.9¢ a lb.

- US equity markets posted mixed closes to open the week. The DJIA continued to soar on strong economic data, bullish corporate earnings reports and an enduring rally in big technology company shares. The S&P 500 backed off its string of record-high closes ahead of more earnings reports this week and key inflation data coming Tuesday in the January Consumer Price Index. The Dow Jones Industrial Average added 125.69 points, or 0.33%, to close at 38,797.38. The Standard & Poor’s 500 eased 4.77 points, or 0.09%, to close at 5,021.84. The Nasdaq Composite fell 48.12 points, or 0.3%, to close at 15,942.55.

- US crude oil prices were higher Monday for a sixth consecutive session. The March West Texas Intermediate light, sweet crude future was up 8¢ to close at $76.92 per barrel.

- The US dollar index strengthened Monday.

- US gold futures were lower Monday. The February contract dropped $5.10 to close at $2,018.20 per oz.

Recap for February 9

- US equity indexes were mixed Friday with the DJIA declining but the S&P 500 closing for the first time above 5,000 points and notching its tenth record-high close of 2024. Driving the rally were shares of big tech companies such as Applied Materials, Nvidia, Alphabet, Amazon and Microsoft. The Dow Jones Industrial Average dropped 54.64 points, or 0.14%, to close at 38,761.69. The Standard & Poor’s 500 added 28.70 points, or 0.57%, to close at 5,026.61. The Nasdaq Composite added 196.95 points, or 1.25%, to close at 15,990.56. All three indexes posted weekly increases during 14 of the past 15 weeks.

- Wheat complex futures posted mixed closes at the end of the week. Bargain buying and short covering was behind Kansas City and nearby Chicago gains with further support from a weaker US dollar. Corn and soybean futures hovered near three-year lows and closed lower Friday under pressure from improved crop weather and forecasts for larger supplies in South America. The March corn future dropped 4¼¢ to close at $4.29 per bu. Chicago March wheat added 8¼¢, closing at $5.96¾ per bu with later months mixed. Kansas City March wheat edged up ½¢ to close at $6.01½ per bu. Minneapolis March wheat also edged up ½¢ to close at $6.84¼ per bu, though all later months declined. March soybeans lost 10¢ to close at $11.83½ per bu. March soybean meal shed 30¢ to close at $346.80 per ton. March soybean oil declined 0.68¢ to close at 47.26¢ a lb.

- US crude oil prices were higher Friday for a fifth consecutive session. The March West Texas Intermediate light, sweet crude future was up 62¢ to close at $76.84 per barrel.

- The US dollar index weakened Friday.

- US gold futures were lower again Friday. The February contract dropped $8.90 to close at $2,023.30 per oz.

Recap for February 8

- On Thursday, wheat complex futures declined under continued US dollar and Russian price pressure as the USDA raised forecasts for the June 1, 2024, carryover of hard red winter, soft red winter and white wheat. Soybean and soybean oil futures rose despite USDA’s bearish soy ending stocks thanks to the Department’s lower forecast for Brazilian production, a figure far higher than forecasts from Brazil’s own crop agency. Corn futures initially went higher after Brazil lowered its corn production forecast but closed lower on the USDA’s increased ending stocks projection. The March corn future dropped 1¢ to close at $4.33¼ per bu. Chicago March wheat shed 13½¢, closing at $5.88½ per bu. Kansas City March wheat fell 17¼¢ to close at $6.01 per bu. Minneapolis March wheat declined 12½¢ to close at $6.83¾ per bu. March soybeans gained 4½¢ to close at $11.93½ per bu. March soybean meal dipped $4.10 to close at $347.10 per ton. March soybean oil rose 1.18¢ to close at 47.94¢ a lb.

- Amid a busy earnings season, shares of Walt Disney, Arm and Hershey advanced Thursday, helping push US equity markets higher. The DJIA and S&P 500 posted record-high closes for a second straight day. The Dow Jones Industrial Average added 48.97 points, or 0.13%, to close at 38,726.33, the index’s 11th record-high close of 2024. The Standard & Poor’s 500 crept up 2.85 points, or 0.06%, to close at 4,997.91, its ninth record-high close of 2024. The Nasdaq Composite added 37.07 points, or 0.24%, to close at 15,793.71.

- US crude oil prices were higher again Thursday for the fourth consecutive session. The March West Texas Intermediate light, sweet crude future was up $2.36 to close at $76.22 per barrel.

- The US dollar index closed higher Thursday, reverting to a recent strengthening trend after a two-day downturn.

- US gold futures turned lower Thursday as the US dollar strengthened. The February contract dropped $3 to close at $2,032.20 per oz.

Recap for February 7

- Corn prices struck a three-year low Wednesday after weather reports indicated competitor Argentina will flip from hot, dry weather to widespread rain. Wheat complex futures were mixed with Chicago soft wheat advancing. Supply pressure stemming from Russia’s surplus and favorable new crop prospects weighed on wheat as traders squared positions ahead of key US and Canadian supply-demand reports coming Thursday. Soybean prices reached the lowest levels since Dec. 15, 2020, as Brazilian growing regions also had rainy forecasts. The March corn future dropped 4½¢ to close at $4.34¼ per bu. Chicago March wheat added 7¢, closing at $6.02 per bu. Kansas City March wheat eased ¼¢ to close at $6.18¼ per bu; later months were narrowly mixed for a second day. Minneapolis March wheat added 3¢ to close at $6.96¼ per bu; later months were narrowly mixed. March soybeans fell 10½¢ to close at $11.89 per bu. March soybean meal shed $7.60 to close at $351.20 per ton. March soybean oil rose 0.82¢ to close at 46.76¢ a lb.

- US equity markets were higher again Wednesday despite recent news about the pace of interest rate cuts. The DJIA and S&P 500 posted record-high closes. The Dow Jones Industrial Average added 156 points, or 0.4%, to close at 38,677.36. The Standard & Poor’s 500 was up 40.83 points, or 0.82%, to close at 4,995.06, its eighth record-high close of 2024. The Nasdaq Composite added 147.65 points, or 0.95%, to close at 15,756.64.

- US crude oil prices were higher again Wednesday. The March West Texas Intermediate light, sweet crude future was up 55¢ to close at $73.86 per barrel.

- The US dollar index declined for a second day Wednesday.

- US gold futures advanced Wednesday as the US dollar weakened. The February contract added 70¢ to close at $2,035.20 per oz.

Recap for February 6

- Wheat complex futures posted mixed closes Tuesday. Chicago soft wheat contracts were up for the first time in three sessions in short covering moves while KC and Minneapolis wheat futures were mixed ahead of key US and Canadan crop reports coming Thursday. Soybean futures popped higher a second day in short covering and technical buying off of lows a day earlier. Corn futures eased in the nearby contract on rainy forecasts for hot, dry Argentina. The March corn future dropped 4¢ to close at $4.38¾ per bu with later months mixed in a narrow range. Chicago March wheat added 4¾¢, closing at $5.95 per bu. Kansas City March wheat added 4½¢ to close at $6.18½ per bu; later months were narrowly mixed. Minneapolis March wheat added 2¼¢ to close at $6.93¼ per bu; later months were mixed. March soybeans rose 3¼¢ to close at $11.99½ per bu. March soybean meal deleted $2.30 to close at $358.80 per ton. March soybean oil rose 0.61¢ to close at 45.94¢ a lb.

- US stocks initially retreated modestly Tuesday with major indexes flipping between small gains and losses before edging higher by closing bells as investors recalibrated their ideas about the Federal Reserve’s interest rate path. The Dow Jones Industrial Average added 141.24 points, or 0.37%, to close at 38,521.36. The Standard & Poor’s 500 was up 11.42 points, or 0.23%, to close at 4,954.23. The Nasdaq Composite added 11.32 points, or 0.07%, to close at 15,609. All three major indexes retained gains for 2024, which was a positive sign for some Wall Street traders.

- US crude oil prices were higher again Tuesday. The March West Texas Intermediate light, sweet crude future was up 53¢ to close at $73.31 per barrel.

- The US dollar index declined Tuesday after a two-session rally.

- US gold futures advanced Tuesday as the US dollar weakened. The February contract added $8.80 to close at $2,034.50 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |