- Stock options worth $3.4 trillion are set to expire on Friday, the largest volume for any September.

- Increasing volatility could lead to price declines, with September being typically the worst-performing month for both the S&P 500 and Bitcoin.

- Markets broadly expect no interest rate hikes by the Fed until the end of 2023, but a surprise could hit risk assets.

Market participants gear up for volatility-filled weeks ahead with a record stock expiry on Friday. $3.4 trillion stock options expire on September 15, days away from the US central bank’s policy announcement next week.

Also read: SEC accuses Binance US of failure to support probe, shifts focus to exchange’s custody arm

Friday’s record stock expiry could trigger downside volatility in Bitcoin

The expiry of $3.4 trillion worth of stock options marks a historic day in the market. Friday’s options expiry is significant for two key reasons: it is the highest dollar value expiry for September, and the month has been typically a negative one in terms of returns for both the S&P 500 and Bitcoin.

S&P 500 has closed lower than its opening price 10 out of the past 11 trading days in September. Bitcoin price has climbed 2.2% this month – the asset opened September at $25,942 and is currently trading at $26,517. Based on data from Coinglass, in the past three years, Bitcoin price yielded 3.12% (2022), 7.03% (2021) and 7.51% (2020) monthly losses in September, respectively.

Akash Girimath, technical analyst at FXStreet shared Bitcoin price performance in September in a recent tweet:

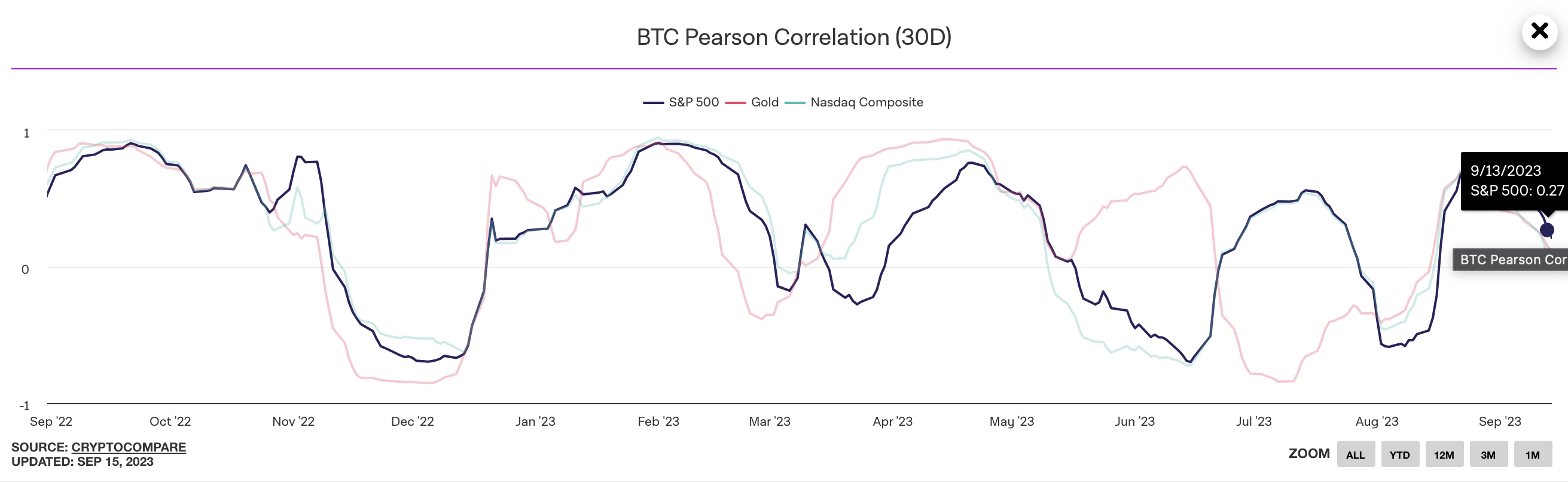

Bitcoin’s one-year correlation with the S&P 500 is 0.27 and this supports the thesis of similar reaction in both the index and the cryptocurrency.

BTC Pearson Correlation (30D)

Traditionally, options expiry coincides with choppy conditions in markets, and in Bitcoin’s case, it is likely that the event will trigger downside volatility in the price, marking another red September for the largest cryptocurrency.

There may be some residual weakness in the weeks following the expiry event, when market participants closely watch the US Federal Reserve’s policy announcement on September 19-20.

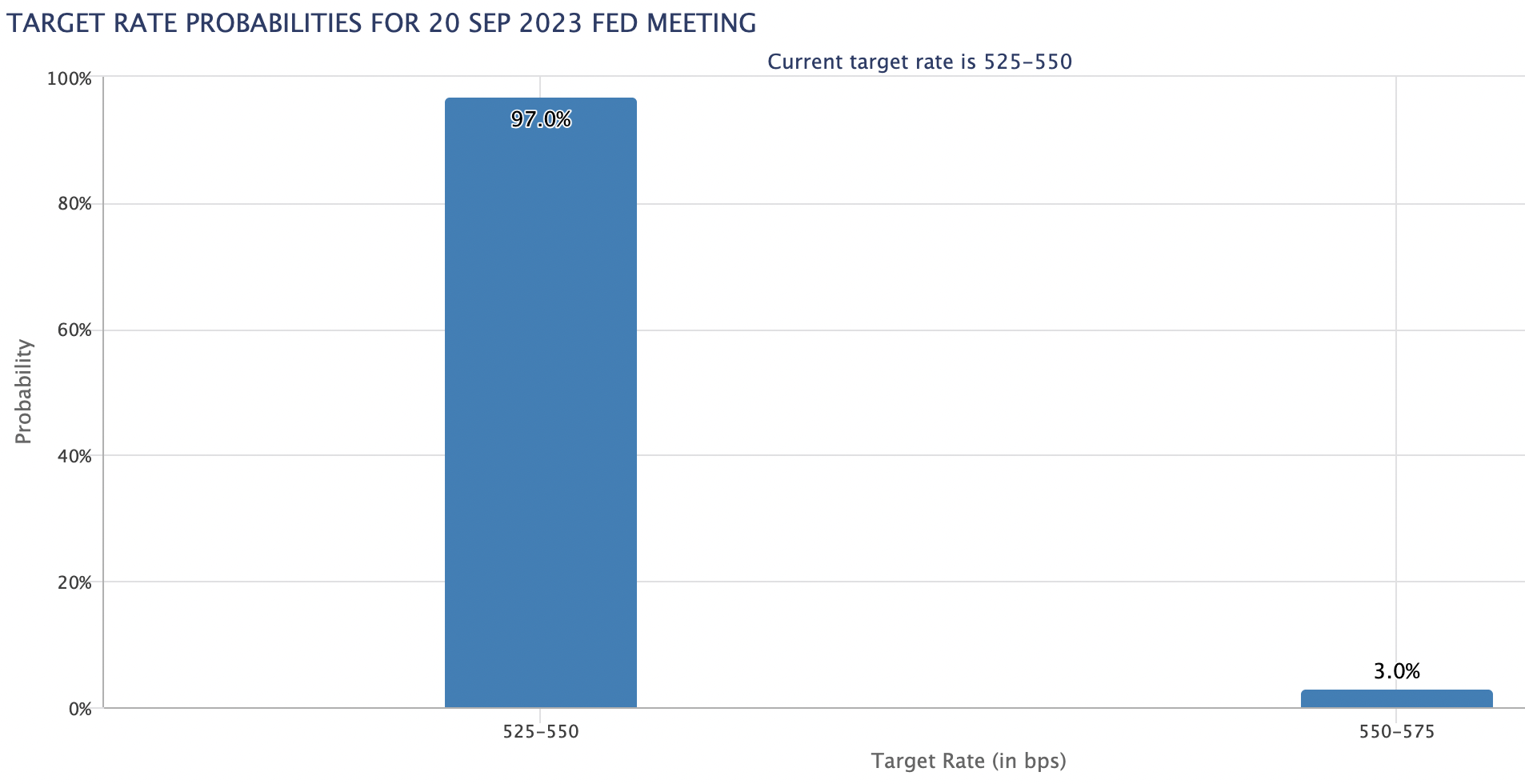

97% chance of no rate hike by the Fed

According to the CME’s FedWatch tool, the market has priced in a 97% chance that the central bank will keep rates at their current level, 525-550 basis points. The number grew 5% from Tuesday, marking confidence among market participants.

Target rate probabilities for Fed’s September 20 meeting on CME FedWatch

If the Federal Reserve surprises markets by raising interest rates on September 20 – an improbable outcome – it is likely to put pressure on Bitcoin price and catch BTC holders off guard, as borrowing gets expensive and BTC price rallies are typically fueled by leverage.

Bitcoin price is holding steady, close to the $26,500 level on Binance, at the time of writing.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Like this article? Help us with some feedback by answering this survey: