Recap for March 11

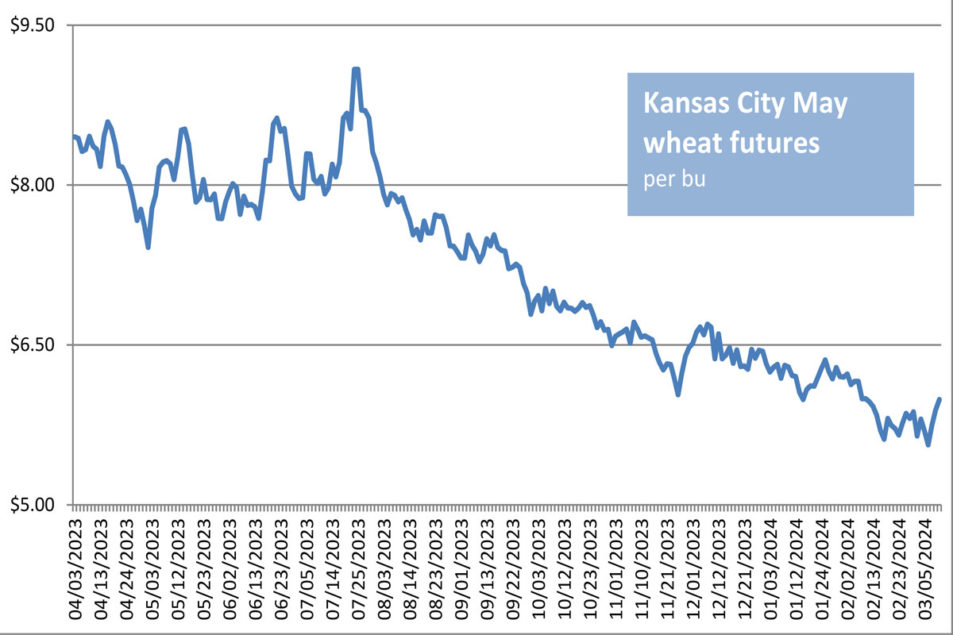

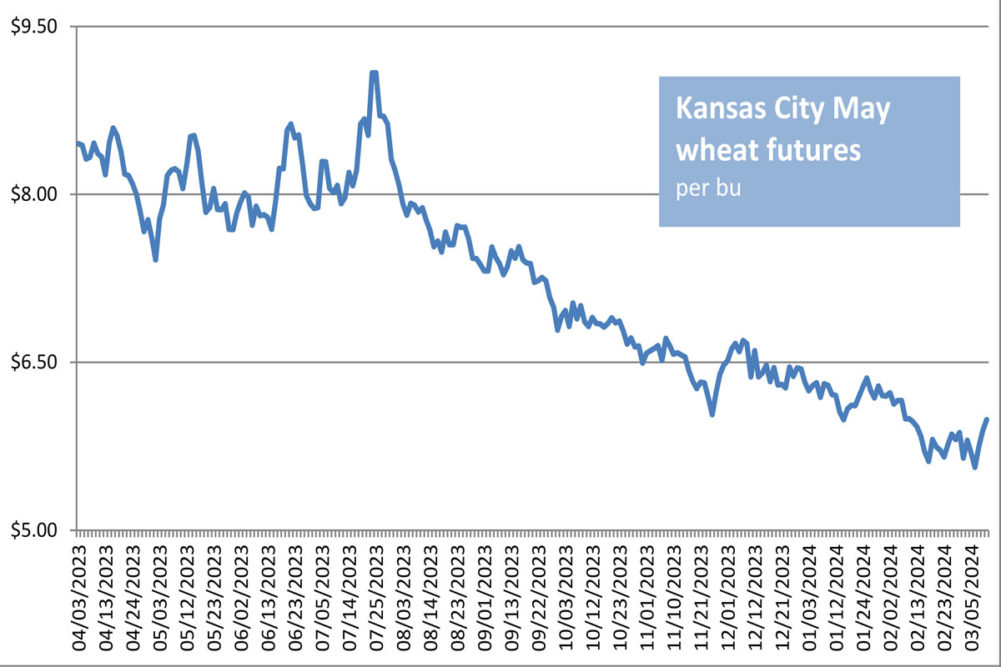

- A significant round of technical positioning and bargain buying helped push wheat futures higher Monday despite pressures from a third cancellation of US soft red winter wheat sales by China, bringing the total voided sum to 504,000 tonnes, nearly a third of what China purchased late last year. Ideas were traders already had factored in the cancellations and may be expecting more. Corn futures firmed on spillover support from wheat. But soybean futures settled lower, pressured by ample production in South America. The May corn future edged up 2¢ to close at $4.41¾ per bu. Chicago May wheat gained 9½¢ to close at $5.47¼ per bu. Kansas City May wheat jumped 10¢ to close at $5.98¾ per bu. Minneapolis May wheat added 7¼¢ and closed at $6.70 per bu. May soybeans slipped 4¾¢ to close at $11.79¼ per bu. May soybean meal lost $4.20 to close at $337.20 per ton. May soybean oil added 0.47¢ to close at 46.64¢ a lb.

- Major US equity indexes were mixed Monday as traders processed economic signals ahead of key inflation data, which likely will determine the extent and start of potential interest rate cuts by the Federal Reserve. The Dow Jones Industrial Average added 46.97 points, or 0.12%, to close at 38,769.66. The Standard & Poor’s 500 lost 5.75 points, or 0.11%, to close at 5,111.94. The Nasdaq Composite dropped 65.84 points, or 0.41%, to close at 16,019.27.

- US crude oil prices were mixed Monday. The April West Texas Intermediate light, sweet crude future eased 8¢ to close at $77.93 per barrel. Later months edged higher.

- The US dollar index reversed course and closed higher Monday, ending a six-session downward streak.

- US gold futures continued to rise Monday. The April contract added $3.10 to close at $2,188.60 per oz.

Recap for March 8

- Wheat futures settled higher Friday, despite another cancellation from China of soft red winter wheat sales and a 15-million-bu bump up in total US 2024 wheat carryout by the USDA in the March 8 supply-and-demand report. Traders attributed the rally to bargain buying after futures fell to a fresh 3½-year-low following the cancellation announcement. Corn futures rose to their highest level in nearly a month on technical positioning following the USDA reports. Soybean futures also advanced on short covering ahead of the weekend. The May corn future ticked up 1¾¢ to close at $4.39¾ per bu. Chicago May wheat gained 9¼¢ to close at $5.37¾ per bu. Kansas City May wheat jumped 14¢ to close at $5.88¾ per bu. Minneapolis May wheat added 8¢ and closed at $6.62¾ per bu. May soybeans jumped 17¾¢ higher to close at $11.84 per bu. May soybean meal rose $7 to close at $341.40 per ton. May soybean oil eased 0.18¢ to close at 46.17¢ a lb; later months were narrowly mixed.

- Major US equity indexes closed lower Friday and ended down for the week following mixed signals from the latest US jobs report. US employers added 275,000 jobs in February, sharply higher than the 198,000 jobs expected. But the unemployment rate ticked up to 3.9% while wage growth slowed and strong figures from recent jobs reports were revised downward. The Dow Jones Industrial Average lost 68.66 points, or 0.18%, to close at 38,722.69. The Standard & Poor’s 500 dropped 33.67 points, or 0.65%, to close at 5,123.69. The Nasdaq Composite fell 188.26 points, or 1.16%, to close at 16,085.11.

- US crude oil prices eased Friday. The April West Texas Intermediate light, sweet crude future dropped 92¢ to close at $78.01 per barrel.

- The US dollar index closed lower for a sixth consecutive trading day Friday.

- US gold futures soared higher Friday. The April contract jumped $20.30 to close at $2,185.50 per oz.

Recap for March 7

- Major US equity indexes jumped higher for a second day on Thursday, the S&P 500 to a 16th record-high close of the year, ahead of the government’s monthly jobs report Friday. The Dow Jones Industrial Average added 130.3 points, or 0.34%, to close at 38,791.35. The Standard & Poor’s 500 advanced 52.6 points, or 1.03%, to close at 5,157.36. The Nasdaq Composite jumped 241.83 points, or 1.51%, to close at 16,273.38.

- Inter-market wheat spreads widened Thursday as nearby Chicago soft wheat contracts declined, losing ground to Minneapolis hard red spring and Kansas City hard red winter futures. The latter two rallied off a two-day slide while front-end Chicago was pressured by a canceled China purchase of US soft wheat and a canceled tender from Egypt. Meanwhile, soybeans hit a two-week high Thursday on strong weekly export data and in pre-WASDE positioning. Corn futures rose 2% in technical trading and short covering. The May corn future jumped 9¼¢ to close at $4.38 per bu. Chicago May wheat ticked down 2½¢ to close at $5.28½ per bu; the December contract and beyond were higher. Kansas City May wheat advanced 18½¢ to close at $5.74¾ per bu. Minneapolis May wheat added 9½¢ and closed at $6.54¾ per bu. May soybeans soared 18¢ higher to close at $11.66¼ per bu. May soybean meal added $4 to close at $334.40 per ton. May soybean oil jumped up 1.03¢ to close at 46.35¢ a lb.

- US crude oil prices were mixed Thursday, lower for the nearest two contracts, higher for July. The April West Texas Intermediate light, sweet crude future dropped 20¢ to close at $78.93 per barrel.

- The US dollar index closed lower for a fifth consecutive trading day Thursday after Fed chairman Jerome Powell said easing interest rates were likely this year should inflation stay in check.

- US gold futures continued higher Thursday. The April contract added $7 to close at $2,165.20 per oz.

Recap for March 6

- Ahead of Friday’s monthly supply and demand estimates report, wheat futures tumbled at midweek on strong global competition while soybeans declined in choppy trading and corn futures firmed up with the support of bargain buying and positioning. Wheat and corn dipped despite a softer US dollar and a move to the high side in US crude oil prices. The May corn future added 2½¢ to close at $4.28¾ per bu. Chicago May wheat sank 20¢ to settle at $5.31 per bu. Kansas City May wheat fell 13¢ to close at $5.56¼ per bu. Minneapolis May wheat dropped 10¼¢ and closed at $6.45¼ per bu. May soybeans eased ¾¢ to close at $11.48¼ per bu. May soybean meal added 50¢ to close at $330.40 per ton; later months were mostly lower in a narrow range. May soybean oil added 0.28¢ to close at 45.32¢ a lb.

- Though they drifted lower near closing bells, US equity indexes ultimately finished higher Wednesday on Federal Reserve chairman Jerome Powell’s testimony before the House Financial Services Committee on Capitol Hill. Powell said the central bank wants more evidence that inflation is slowing sustainably before beginning to cut interest rates this year. The three indexes remained lower for the week to date. The Dow Jones Industrial Average added 75.86 points, or 0.20%, to close at 38,661.05. The Standard & Poor’s 500 advanced 26.11 points, or 0.51%, to close at 5,104.76. The Nasdaq Composite packed on 91.95 points, or 0.58%, to close at 16,031.54.

- US crude oil prices reversed course and closed higher Wednesday. The April West Texas Intermediate light, sweet crude future added 98¢ to close at $79.13 per barrel.

- The US dollar index closed lower for a fourth consecutive trading day Wednesday.

- US gold futures advanced again Wednesday. The April contract added $16.30 to close at $2,158.20 per oz.

Recap for March 5

- Corn, soybean and wheat futures could not sustain overnight bargain-buying rises and dropped lower Tuesday. Corn and soybeans hovered near three-year lows ahead of Friday’s updated supply and demand numbers from the US Department of Agriculture. Soybeans were under pressure from increased fund selling. Wheat tumbled alongside declining European wheat futures amid weakening prices in the Black Sea, believed to be the winning origin from Algeria’s tender. The May corn future lost 3¾¢ to close at $4.26¼ per bu. Chicago May wheat dropped 13¢ to settle at $5.51 per bu. Kansas City May wheat fell 11¢ to close at $5.69¼ per bu. Minneapolis May wheat dropped 4¢ but closed at $6.55½ per bu. May soybeans were down 6¢ to close at $11.49 per bu. May soybean meal shed $3.60 to close at $329.90 per ton. May soybean oil eased 0.13¢ to close at 45.04¢ a lb.

- The Magnificent Seven stocks of gigantic tech companies, save for Nvidia, all pulled lower Tuesday, dragging major equity markets further from recent record highs. Trading was cautious ahead of key data coming from the government, including a jobs report Friday. The Dow Jones Industrial Average fell 404.64 points, or 1.04%, to close at 38,585.19. The Standard & Poor’s 500 gave back 52.3 points, or 1.02%, to close at 5,078.65. The Nasdaq Composite sank 267.92 points, or 1.65%, to close at 15,939.59.

- US crude oil prices declined again Tuesday. The April West Texas Intermediate light, sweet crude future dropped 59¢ to close at $78.15 per barrel.

- The US dollar index closed lower for a third consecutive trading day Tuesday.

- US gold futures advanced again Tuesday. The April contract added $15.60 to close at $2,141.90 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |