Recap for February 16

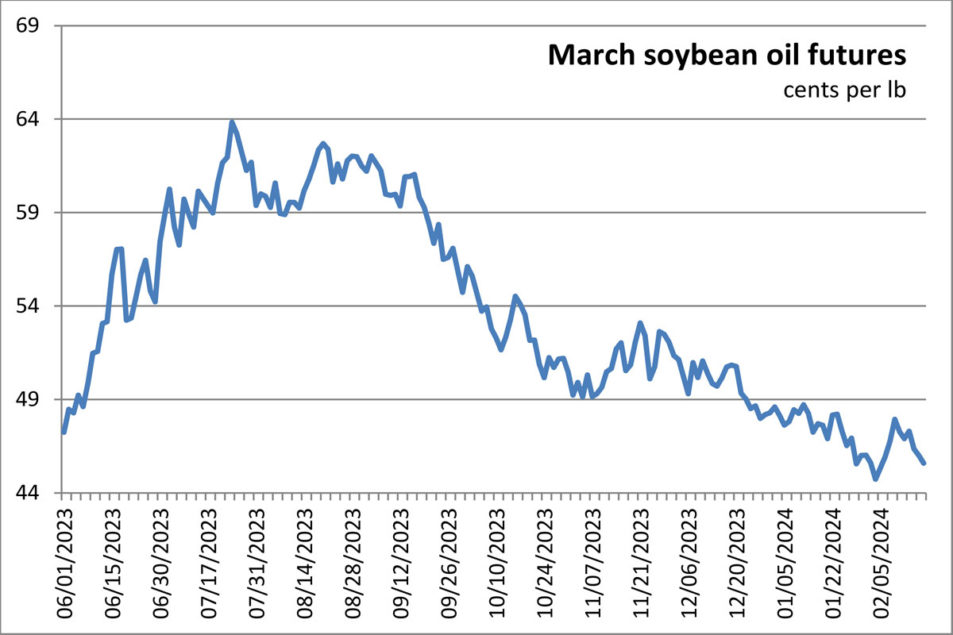

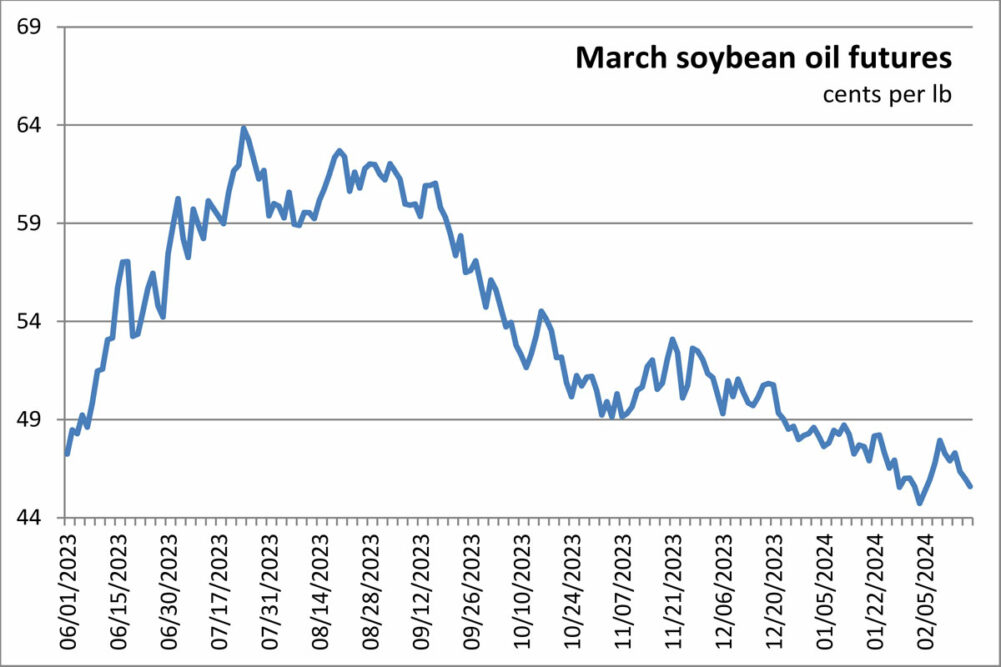

- Wheat futures slid to fresh contract lows Friday on continued pressure from weak export demand due to lower-priced supplies from Russia and Ukraine, and on prospects for higher US production in 2024. Corn futures were mixed, mostly higher, and soybean futures posted modest gains after both set three-year lows during the week on ample domestic and global supplies. The March corn future slipped 1¼¢ to close at $4.16½ per bu, but July and beyond were firmer. Chicago March wheat dropped 6½¢ to settle at $5.60½ per bu. Kansas City March wheat declined 8½¢ to close at $5.67¼ per bu. Minneapolis March wheat lost 3¼¢ to close at $6.54¾ per bu. March soybeans advanced 10¢ to close at $11.72¼ per bu. March soybean meal added $6.10 to close at $345.60 per ton. March soybean oil lost 0.41¢ to close at 45.59¢ a lb.

- US equity indexes declined on Friday and ended the week with losses. Traders processed multiple pressuring economic reports from the week, including hotter-than-expected inflation data (likely to delay the Fed’s interest rate cuts) and contracting retail sales. The Dow Jones Industrial Average fell 145.13 points, or 0.37%, to close at 38,627.99. The Standard & Poor’s 500 dropped 24.16 points, or 0.48%, to close at 5,005.57. The Nasdaq Composite lost 130.52 points, or 0.82%, to close at 15,775.65.

- US crude oil prices were higher Friday. The March West Texas Intermediate light, sweet crude future added $1.16 to close at $79.19 per barrel.

- The US dollar index declined for a third session on Friday.

- US gold futures advanced again on Friday. The February contract rose $9.40 to close at $2,011.50 per oz.

Recap for February 15

- Grain futures dropped Thursday after the US Department of Agriculture forecast larger crop inventories for the 2024-25 marketing year amid waning global demand for US supplies. Both corn and soybean futures touched fresh three-year lows. Kansas City and Minneapolis wheat futures notched fresh contract lows while the Chicago March contract settled at its lowest level since late November. The March corn future dropped 6½¢ for a second straight day to close at $4.17¾ per bu. Chicago March wheat fell 18½¢ to settle at $5.67 per bu. Kansas City March wheat declined 12¢ to close at $5.75¾ per bu. Minneapolis March wheat lost 4½¢ to close at $6.58 per bu. March soybeans were down 8¼¢ to close at $11.62¼ per bu. March soybean meal was $3.80 lower to close at $339.50 per ton. March soybean oil lost 0.35¢ to close at 46¢ a lb.

- US equity indexes brushed off a disappointing retail sales report, illuminating clinks in the consumer resilience armor, and closed higher on Thursday. The S&P 500 set another all-time high close, its eleventh record of the year. The Dow Jones Industrial Average jumped 348.85 points, or 0.91%, to close at 38,773.12. The Standard & Poor’s 500 added 29.11 points, or 0.58%, to close at 5,029.73. The Nasdaq Composite gained 47.03 points, or 0.30%, to close at 15,906.17.

- US crude oil prices were higher Thursday. The March West Texas Intermediate light, sweet crude future added $1.39 to close at $78.03 per barrel.

- The US dollar index declined again on Thursday.

- US gold futures advanced Thursday. The February contract gained $11.80 to close at $2,002.10 per oz.

Recap for February 14

- Wheat complex futures were lower again Wednesday, notching fresh contract lows after the value of the US dollar touched a three-month high during the trading session before ending lower for the day. Corn and soybean futures followed wheat futures lower, sinking to three-year lows, dragged further down by fund selling and ample global supplies. The March corn future dropped 6½¢ to close at $4.24¼ per bu. Chicago March wheat fell 12¢ to settle at $5.85½ per bu. Kansas City March wheat declined 6¾¢ to close at $5.87¾ per bu. Minneapolis March wheat lost 9¼¢ to close at $6.62½ per bu. March soybeans tumbled 15¾¢ to close at $11.70½ per bu. March soybean meal eased $1.50 to close at $343.30 per ton. March soybean oil fell 0.95¢ to close at 46.35¢ a lb.

- US equity indexes Wednesday recovered a portion of losses incurred Tuesday that resulted mainly from higher-than-expected inflation data that was expected to slow or delay the Fed’s interest rate cuts. Today, Treasury yields declined as traders tried to determine when the Fed would begin to lower rates and “dip buyers” were active. The Dow Jones Industrial Average gained 151.52 points, or 0.40%, to close at 38,424.27. The Standard & Poor’s 500 added 47.45 points, or 0.96%, to close at 5,000.62. The Nasdaq Composite jumped 203.55 points, or 1.3%, to close at 15,859.15.

- US crude oil prices reversed course Wednesday after posting gains in the seven prior consecutive trading sessions. The March West Texas Intermediate light, sweet crude future dropped $1.23 to close at $76.64 per barrel.

- The US dollar index declined on Wednesday.

- US gold futures were lower Wednesday. The February contract lost $2.60 to close at $1,990.30 per oz.

Recap for February 13

- Wheat complex futures were mostly lower Tuesday, some hitting contract lows, as the dollar hit a three-month peak, international demand lulled during Lunar New Year and Russia extended its bargain basement grain prices. Technical trading slightly firmed corn futures, though prices hewed near three-year lows on ample global supplies, improving harvest prospects in South America and export competition. Soybean futures followed soymeal futures lower after the US soybean crush slowed in January from February’s record as frigid weather disrupted operations at several processing plants. The March corn future edged up ¼¢ to close at $4.30¾ per bu. Chicago March wheat was steady at a $5.97½ per bu close; later months eased for a second day. Kansas City March wheat fell 4¼¢ to close at $5.94½ per bu. Minneapolis March wheat fell 10¾¢ to close at $6.71¾ per bu. March soybeans dropped 6¾¢ to close at $11.86¼ per bu. March soybean meal fell $4.10 to close at $344.80 per ton. March soybean oil added 0.40¢ to close at 47.30¢ a lb.

- US stocks and equity indexes declined Tuesday after a Department of Labor report indicated consumer prices rose 3.1% in January from a year earlier, versus a December gain of 3.4%, the lowest measure since June. The Consumer Price Index still was higher than the predicted 2.9%, which disappointed investors hoping the Fed will cut rates sooner rather than later. Core prices, a measure that excludes food and energy, were up 0.4%. The Dow Jones Industrial Average dropped 524.63 points, or 1.35%, to close at 38,272.75. The Standard & Poor’s 500 shed 68.67 points, or 1.37%, to close at 4,953.17. The Nasdaq Composite fell 286.95 points, or 1.8%, to close at 15,655.60.

- US crude oil prices were higher Tuesday for a seventh consecutive session. The March West Texas Intermediate light, sweet crude future was up 95¢ to close at $77.87 per barrel.

- The US dollar index strengthened again on Tuesday.

- US gold futures were lower Tuesday. The February contract dropped $25.30 to close at $1,992.90 per oz.

Recap for February 12

- Soybean futures jumped higher Monday in a round of bargain buying off of last week’s three-year lows. Corn futures also notched bargain-buying gains to a lesser degree. Wheat complex futures were mixed, mostly lower, on ongoing global export price competition and weak export demand for US supplies. The March corn future added 1½¢ to close at $4.30½ per bu. Chicago March wheat added ¾¢, closing at $5.97½ per bu though most later months eased. Kansas City March wheat fell 2¾¢ to close at $5.98¾ per bu. Minneapolis March wheat fell 1¾¢ to close at $6.82½ per bu. March soybeans jumped 9½¢ to close at $11.93 per bu. March soybean meal added $2.10 to close at $348.90 per ton. March soybean oil declined 0.36¢ to close at 46.9¢ a lb.

- US equity markets posted mixed closes to open the week. The DJIA continued to soar on strong economic data, bullish corporate earnings reports and an enduring rally in big technology company shares. The S&P 500 backed off its string of record-high closes ahead of more earnings reports this week and key inflation data coming Tuesday in the January Consumer Price Index. The Dow Jones Industrial Average added 125.69 points, or 0.33%, to close at 38,797.38. The Standard & Poor’s 500 eased 4.77 points, or 0.09%, to close at 5,021.84. The Nasdaq Composite fell 48.12 points, or 0.3%, to close at 15,942.55.

- US crude oil prices were higher Monday for a sixth consecutive session. The March West Texas Intermediate light, sweet crude future was up 8¢ to close at $76.92 per barrel.

- The US dollar index strengthened Monday.

- US gold futures were lower Monday. The February contract dropped $5.10 to close at $2,018.20 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |