(Bloomberg) — Zoom Video Communications Inc. reported better-than-expected revenue on strong enterprise sales, a sign the company is holding its own in a competitive market for business collaboration software.

Most Read from Bloomberg

Fiscal third-quarter sales increased 3.2% to about $1.14 billion, the company said Monday in a statement. Analysts, on average, estimated $1.12 billion, according to data compiled by Bloomberg. Profit, excluding some items, was $1.29 a share, compared with the average estimate of $1.10 a share.

The company, whose signature video software became the essential communications tool for homebound Americans during the pandemic, has turned its focus to business customers. Zoom has added features for those clients, including word processing, and stepped up the use of artificial intelligence to buttress its main videoconferencing service, which competes fiercely with Microsoft Corp.’s Teams product.

Enterprise revenue from 219,700 customers rose 7.5% to $661 million in the quarter ended Oct. 31, topping analysts’ average estimate. Zoom said it had 3,731 clients that contribute more than $100,000 in trailing 12-month revenue — an increase of almost 14% from the period a year earlier.

“We bolstered Zoom’s all-in-one intelligent collaboration platform with advanced new capabilities like Zoom AI Companion and continued to evolve our customer and employee engagement solutions,” Chief Executive Officer Eric Yuan said in the statement.

The results “are encouraging to us amid the company’s need to offset a slowdown in its consumer unit with higher sales to business customers,” wrote John Butler, an analyst at Bloomberg Intelligence, adding that Zoom’s focus on expanding profitability “also appears clearly on track.“

Still, a revenue forecast of $1.125 to $1.13 billion in the current quarter fell just shy of analysts’ estimates. Profit, excluding some items, will be about $1.14 a share in the period ending in January, compared with the average estimate of $1.09.

The guidance “was more mixed” than the reported quarter, wrote Tyler Radke, an analyst at Citigroup Inc.. But the results overall were a “bit stronger than feared.” Ahead of the earnings, he wrote that “Zoom still faces significant risks, some arguably existential, with looming Microsoft competition and lack of pricing and peaking margins.”

Shares gained about 1% in extended trading after closing at $66 in New York. Zoom has missed the artificial-intelligence fueled tech rally this year, with the stock dropping 2.6% through Monday’s close.

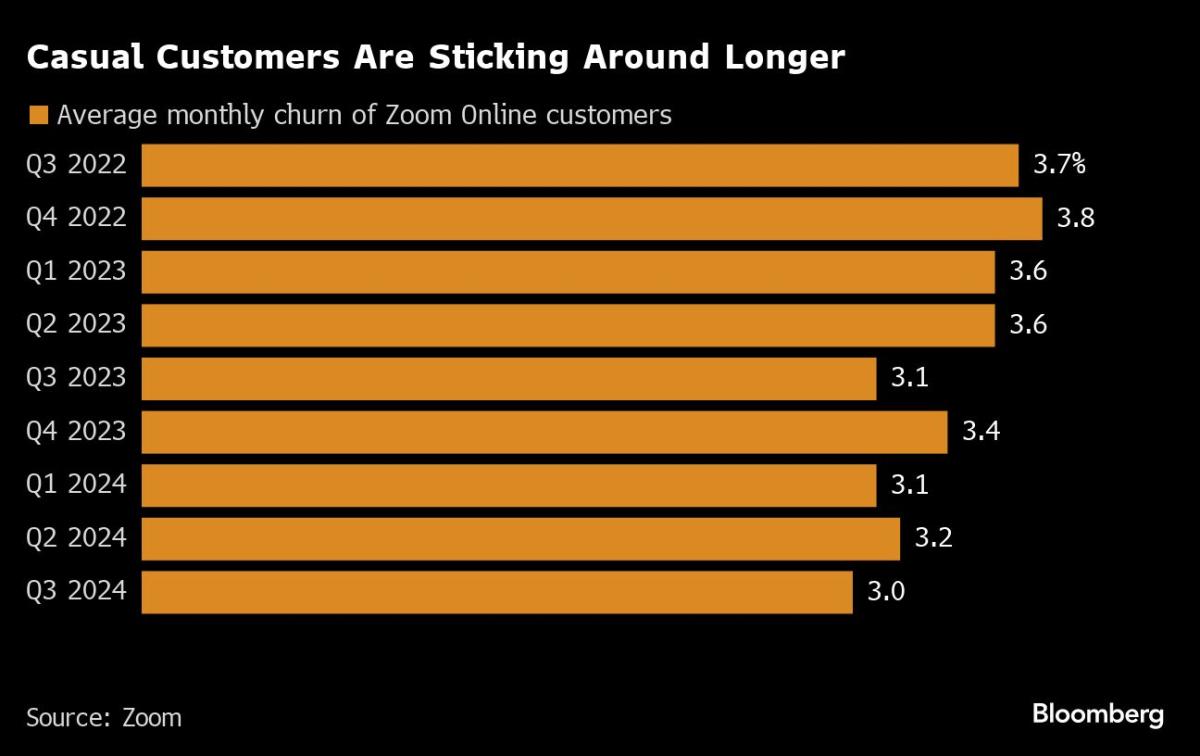

A post-pandemic exodus of casual customers and small businesses from Zoom has worried investors over the last year. Those users are generally higher-margin because they don’t require interaction with salespeople. Yuan highlighted “higher retention” and usage of new AI features among those online clients. Zoom, on average, lost 3% of those customers each month in the quarter, which is was the slowest rate of churn the company has ever reported.

“Over time you should see retention continue to improve,” Chief Financial Officer Kelly Steckelberg said of the churn rate during a conference call after the earnings were released.

Zoom Phone, one of the company’s most important secondary bets, hit 7 million paid users in the quarter, Steckelberg said. Its contact center product reached 700 customers, she added. Sales declined outside of the Americas in the quarter, Steckelberg said, with the European and Asian regions declining 2%. Sales in the Americas were up 5%.

(Updates with comments from analysts beginning in the seventh paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Source link

credite